Class 12th Chapters

- 1. Partnership – Fundamentals

- 2. Partnership – Goodwill

- 3. Partnership – Change in PSR

- 4. Partnership – Admission of Partner

- 5. Partnership – Retirement of Partner

- 6. Partnership – Death of a Partner

- 7. Partnership – Dissolution of Partnership Firm

Partnership – Fundamentals

Topic – 1 | PARTNERSHIP BASICS:

Study Material & Notes

Study Material & Notes for the Chapter 1

Partnership – Fundamentals

I. PARTNERSHIP BASICS

A. Partnership-Definition

The Indian Partnership Act 1932, Section 4

“Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

- Relation between persons

- Who have agreed (written/oral)

- To share the profits (losses)…business with a motive to earn profits

- Of a business…legal business (theft/cheating, scam)

- Carried on by all or

- Any of them acting for all

B. Nature of Partnership

C. Nature of Partnership

- To share profits in an agreed ratio

- To take part in the conduct of the business

- Right to be consulted

- Right to inspect the books of accounts

- Right to retire from the firm

- To disallow admission of new partners (Imp).

- Example 40 partners, want to admit new partner, one partner says No

D. Contents of Partnership Deed

- Partnership agreement is the mutual understanding on which Partners decide to do a legal business to earn profits.

- It may be oral or written.

- The written, signed and registered version of the agreement is also called partnership deed

- Deed is optional/non mandatory/non compulsory but recommended

- Profit will be distributed/apportioned as per the agreement

- Agreement once made needs to be honoured in all the conditions

- The Partnership Deed may contains basically two types of matters:

- Management related matters

- Money related matters

E. Provisions relevant for Accounting

F. Interest on Loan given by Partner

- Is a charge against profit (accrued even if no Profits)

- Interest rate is as provided in the Partnership deed

- If no partnership deed or not provided in partnership deed – @6% p.a.

- Interest = Amount of Loan X Rate of Interest X Time

- Interest is credited to Partner Loan Account (and not to Partner Capital/Current A/C)

Journal Entry

G. Rent Payable to Partner

- Is a charge against profit (accrued even if no Profits)

- Charge since rent is paid for using property for business purpose

- Rent is credited to Rent Payable Account (and not to Partner Capital/Current A/C) Capital/Current A/C)

Journal Entry

H. Remuneration to Partner – Salary/Commission

- Payable only if provided in the partnership deed

- If loss – it is not payable, If sufficient profits – Fully allowed

- If insufficient profits – Profits are distributed in the ratio of Salary/Commission to be allowed

- Salary/Commission is credited to Partner’s Capital/Current Account

Journal Entry

Topic – 2 | INTEREST ON CAPITAL AND DRAWINGS:

Study Material & Notes

Study Material & Notes for the Chapter 1

Partnership – Fundamentals

II. INTEREST ON CAPITAL AND DRAWINGS

A. Interest on Capital

- Interest is computed on time proportion basis, number of days capital deployed in Firm

- Interest is computed only on Opening Capital, Additional Capital & drawings against capital

- Interest is not computed on Profit/Loss

- Interest on Capital= Amount of capital X Rate of Interest X Time

- If only Closing Capital is given, interest cannot be computed on Closing capital

- We need to find out Opening Capital and capital additions/deletions

- If Opening Capital is not given prepare Capital A/C or use formula

- Opening Capital=Closing Capital + Loss + Drawings- Profit – Additional Capital

- Prepare Ledger Account as per the below format

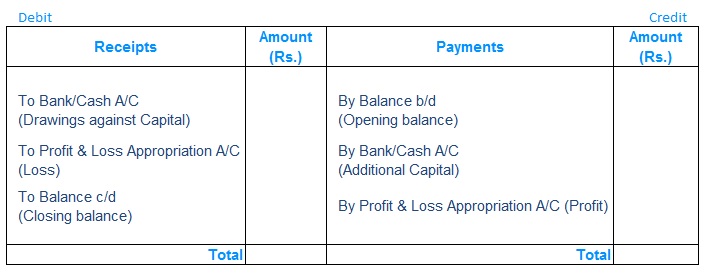

Partner Capital Account

For the year ended …………………….

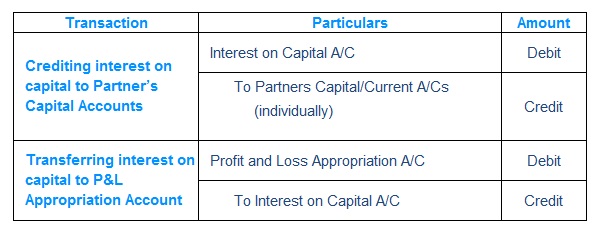

Journal Entry

B. Interest on Drawings

- Product Method (unequal amount withdrawn at different dates)

- Simple Method – Interest is computed for each drawing separately using simple interest formula:

- Product Method – Interest is computed for each drawing separately using simple interest formula:

Product = Each Drawing x No. of Months till Financial year end

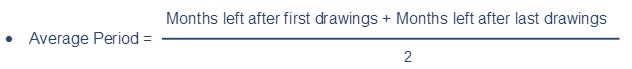

- Average Period Method (Uniform drawings & uniform time internal)

- Two prerequisites / condition of using this method

- Uniform/Similar time intervals…monthly, quarterly, half-yearly etc.

- Uniform/Similar amounts on each interval say 1000, 5000, 10000 etc.

Important to Note:

- If date of withdrawal is not given, the interest on total drawings for the year is calculated for six months on the average basis

- When rate of interest is given without the word ‘per annum’ interest is charged without considering the time factor.

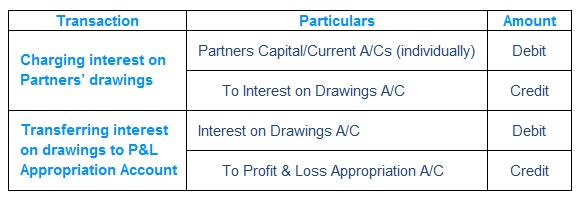

Journal Entry

Topic – 3 | PROFIT & LOSS APPROPRITATION ACCOUNT AND FIXED & FLUCTUATING CAPITAL :

Study Material & Notes

Study Material & Notes for the Chapter 1

Partnership – Fundamentals

III. PROFIT & LOSS APPROPRITATION ACCOUNT

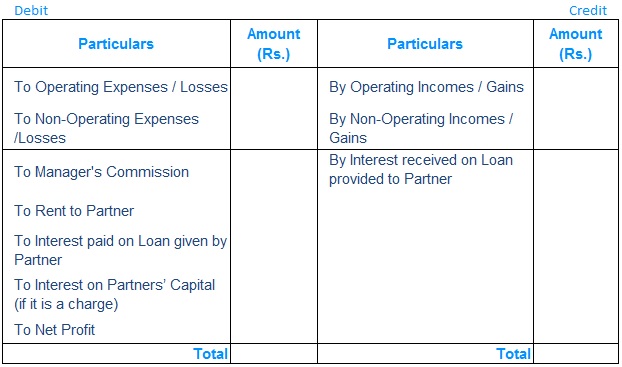

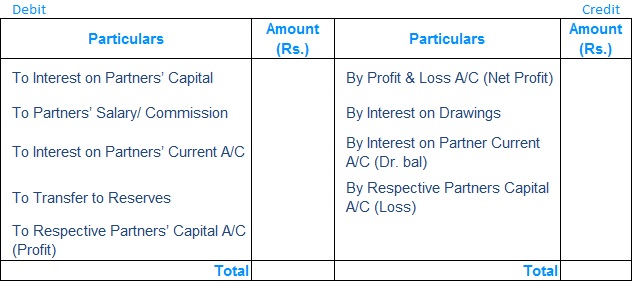

Profit & Loss Account

Profit & Loss Appropriation Account

Appropriation > Available Profits

Profit is distributed in the ratio of appropriations to be made, determined as follows:

- Determine the amount payable as appropriation to each partner as per the Partnership deed (e.g. Salary, commission, interest on capital)

- Total the amount of appropriations for each partner separately

- The ratio of total appropriations amongst partners becomes the ratio for distribution of available profits among the partners

Study Material & Notes for the Chapter 1

Partnership – Fundamentals

IV. FIXED AND FLUCTUATING CAPITAL

Capital Accounts

A. Fixed Capital

- Partners’ Capital Accounts

- Partners’ Current Accounts

B. Fluctuating Capital

- Partners’ Capital Accounts

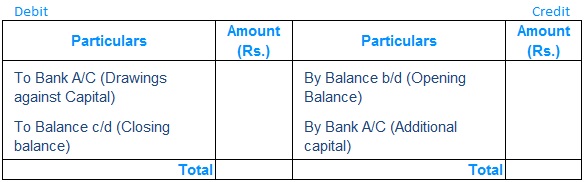

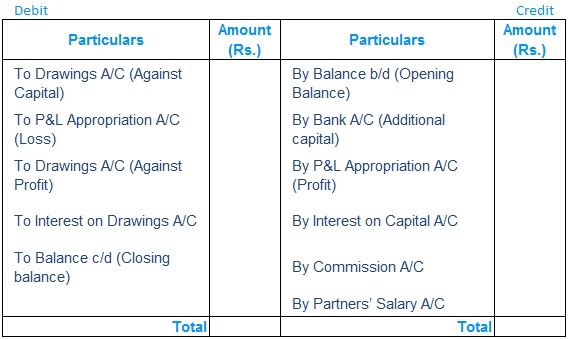

A. Fixed Capital Ledgers

Partners’ Capital Accounts

Partners’ Current Accounts

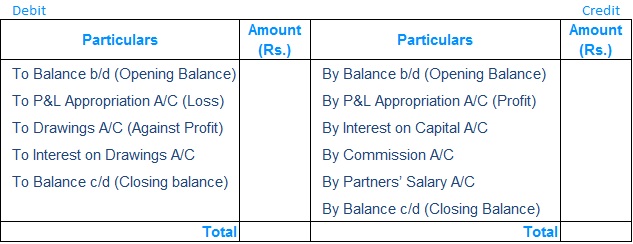

B. Fluctuating Capital Ledgers

Partners’ Capital Accounts

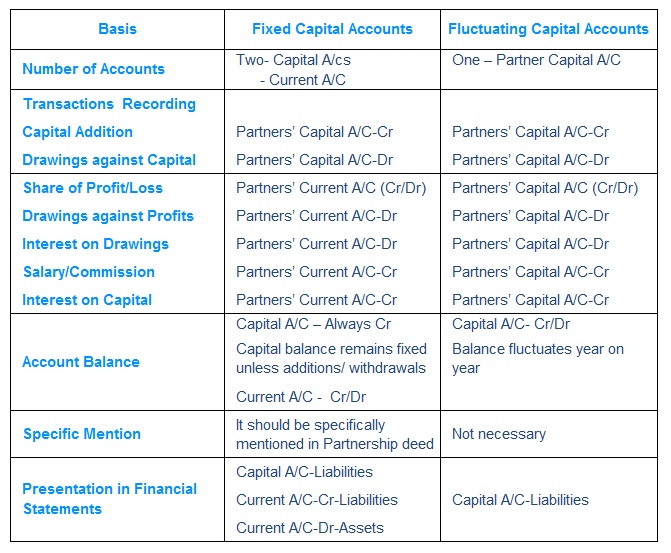

C. Difference between Fixed & Fluctuating Capital Methods

In the absence of any information, always prepare fluctuating A/C

Topic – 4 | PAST ADJUSTMENT:

Study Material & Notes

Study Material & Notes for the Chapter 1

Partnership – Fundamentals

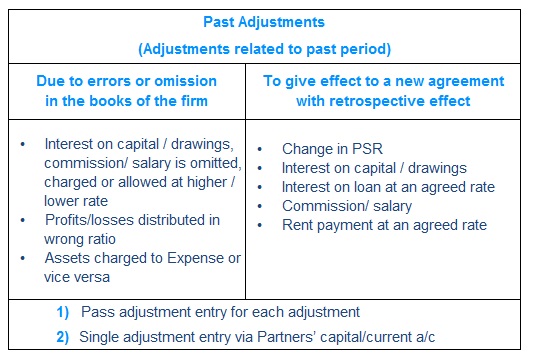

V. PAST ADJUSTMENT

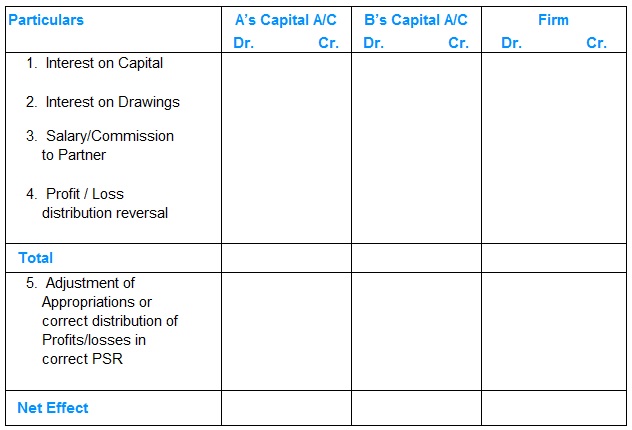

Method-1 When net impact is routed through partners accounts Process Steps

- Prepare an analytical table in the following format

- Benefits to partners are mentioned on credit side of respective Partner column and on the debit side of firm and vice versa

- Total of columns designated to firm will give Firm’s net profit/loss

- Distribute the profit/loss in profit sharing ratio

- Sum partners columns and compute difference of total debit and total credit

- If net difference is debit, that partner’s capital account will be debited and vice versa

Journal Entry

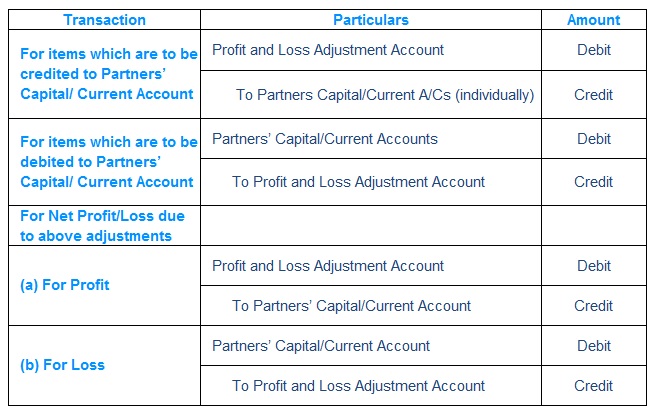

Method-2 Adjustment entry for each adjustment

Topic – 5 | GUARANTEE OF PROFITS:

Study Material & Notes

Study Material & Notes for the Chapter 1

Partnership – Fundamentals

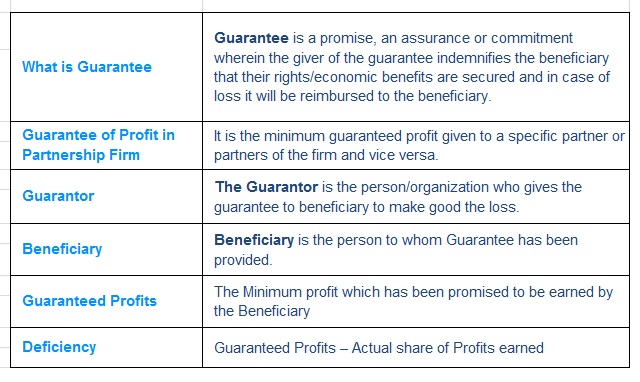

VI. GUARANTEE OF PROFITS

A. Definitions

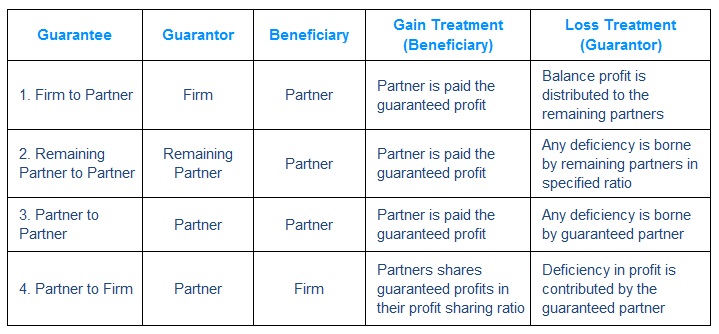

B. Type of Guarantees

C. Order of applying Guarantees

In case in a question two or more Guarantees are to be applied then this order is to be followed

- By Partner To Firm

- By Firm to Partner

- By Partner to Another Partner(s)

When beneficiary’s actual share of profit is more than the guaranteed amount, then his share of profit is given to him, not guaranteed amount of profit.

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Partnership – Goodwill

Topic – 1 | GOODWILL – DEFINITION & FEATURES:

Study Material & Notes

Study Material & Notes for the Chapter 2

Partnership – Goodwill

I. GOODWILL – DEFINITION & FEATURES

A. Goodwill

Goodwill is the benefit and advantage of the good name, reputation, and connection of a business. It is the attractive force which brings in customers. It is one factor which distinguishes an old established business from a new business at its first start.

- Good will = Good name or Reputation

- Is an Intangible asset…cannot be seen or touched

- Places an enterprise at an advantageous position due to efforts made in the past

- Enterprise is able to earn higher profits without extra efforts

B. Factors affecting valuation of Goodwill

C. Need for valuation of Goodwill

- At the time of admission, retirement or death of a partner.

- Change in the profit-sharing ratio amongst the existing partners.

- When the partnership firm is sold out.

- When the firms amalgamate (merge)

- When the firm is converted into Company

D. Classification of Goodwill

1) Purchased (Acquired) Goodwill

- It is the goodwill that is acquired by a business after paying consideration in cash or in kind.

- For example, consideration paid Rs. 10 lacs for purchase of a business wherein Assets acquired valued Rs. 20 lacs & Liabilities taken over for Rs. 12 lacs. Extra Rs. 2 Lacs is paid here for Goodwill.

2) Self Generated Goodwill

- It is internally generated or hard-earned goodwill which arises due to continued hard work of the organization, its better-quality products and better customer services.

- Self-generated goodwill is not recorded in the books because no consideration in money or money’s worth is paid for it.

Important to Note: As per AS-26 Goodwill should not be recorded in books unless it is purchased

Topic – 2 | METHODS OF VALUATION OF GOODWILL:

Study Material & Notes

Study Material & Notes for the Chapter 2

Partnership – Goodwill

II. METHODS OF VALUATION OF GOODWILL

A. Simple Average Profit

Goodwill = Simple Average Profit X Number of years purchased

Where:

Simple Average profit = Simple Average of pure profit of last few years

Computation of Pure Profits

Profit or Loss of past year (before adjustments)

Add:

- Abnormal losses (e.g., loss by fire, theft etc.)

- Loss on sale of fixed assets

- Overvaluation of Opening stock or Undervaluation of Closing Stock

- Non-recurring expenses

- Assets treated as expense less depreciation

Less:

- Abnormal gains

- Profit on sale of fixed assets

- Overvaluation of Closing stock or Undervaluation of Opening Stock

- Non-recurring incomes

- Expenses treated as assets less depreciation

- Partners Salary

Number of years purchased = For how many years firm will earn same profits (this is given in the question)

B. Weighted Average Profit

Goodwill = Weighted Average Profit X Number of years purchased

Where:

Weighted Average profit = Weighted Average of pure profit of last few years

- Weights for each year Profit is given in the question

- Pure Profit is multiplied by weight of respective year and ‘Product’ is obtained

- Weighted Average Profit = Total Product / Total Weights

Number of years purchased = For how many years firm will earn same profits (this is given in the question)

C. Super Profit Method

Goodwill = Super Profit X Number of years purchased

Where:

Super Profit = Average Profit – Normal profit

Average profit = Simple Average of pure profit of last few years

Normal Profit = Normal Profit is the Profit earned by similar firms in similar businesses and can be computed with the formula

Average Capital Employed X Normal Rate of Return

Average Capital Employed =

(Capital Employed at beginning of year + Capital Employed at end of year) / 2

Normal Rate of Return = Rate of return earned by the similar firms in the market. This rate is already given in the question

Number of years purchased = For how many years firm will earn same profits (this is given in the question)

Computation of Capital Employed

Liabilities Side Approach

Capital

Add:

- Reserves

Less:

- Non-trade Investments

- Goodwill

- Advertisement Suspense

Assets Side Approach

All Assets (excluding goodwill, fictitious assets, Non-trade Investments)

Less:

- Outside Liabilities

D. Capitalization of Super Profit Method

Goodwill = Super Profit X

Where:

Super Profit = Average Profit – Normal profit

Average profit = Simple Average of pure profit of last few years

Normal Profit = Profit earned by similar firms in similar businesses and can be computed with the formula:

Average Capital Employed X Normal Rate of Return

Normal Rate of Return = Rate of return earned by the similar firms in the market. This rate is already given in the question

E. Capitalization of Average Profits

Goodwill Employed = Average Profits X

– Net Assets or Average Capital

- As per the profit earned by firm, how much capital is required for the same (using normal rate)

- How much Capital Firm has put in the business (Capital Employed)

- If the Firm is able to earn more profits even by putting lesser capital, it is because of Firm’s Goodwill

Where:

Average Profits = Simple Average of pure profit of last few years

Normal Rate of Return = Rate of return earned by the similar firms in the market. This rate is already given in the question

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Partnership – Change in PSR

Topic – 1 | DETERMINATION OF SACRIFICING & GAINING RATIO:

Study Material & Notes

Study Material & Notes for the Chapter 3

Partnership – Change in Profit Sharing Ratio

I. DETERMINATION OF SACRIFICING & GAINING RATIO

A. Definitions

B. Sacrificing/(Gaining) Ratio

Sacrificing/(Gaining) Share = Old Share – New Share

If a Partner’s Old Share – New Share is Positive (+) figure then the partner has made a sacrifice

If a Partner’s Old Share – New Share is Negative (-) figure then the partner has made a gain

Topic – 2 | ACCOUNTING FOR GOODWILL:

Study Material & Notes

Study Material & Notes for the Chapter 3

Partnership – Change in Profit Sharing Ratio

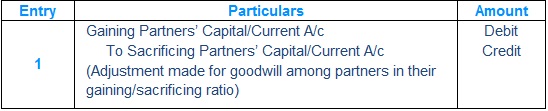

II. ACCOUNTING FOR GOODWILL

- If Partners decide to change their profit-sharing ratio, the gaining partner must compensate the sacrificing partner

- The compensation by gaining partner to the sacrificing partner is payment of Goodwill in the gaining ratio

- If Partner B gained 1/10 of the share and Partner A scarified 1/10 of the share and goodwill of the Firm is Rs. 5,00,000/- then Partner B should compensate Partner A for: Rs. 5,00,000 X (1/10)= Rs. 50,000/-

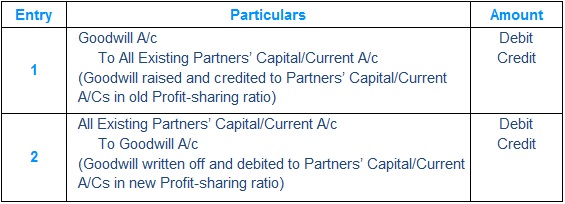

Case-1 Goodwill is not appearing in the books of accounts

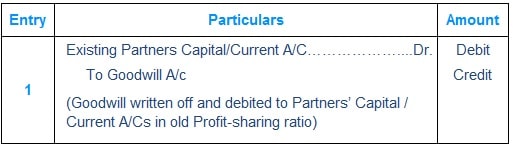

Method-1 Goodwill is raised and then written off

Method-2 Goodwill is adjusted through Partners’ Capital Accounts

Important to Note: If question is silent, treat Capital Accounts as Fluctuating

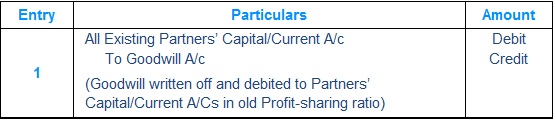

Case-2 Goodwill is appearing in the books of accounts

Method-1 Existing Goodwill is written off

Important to Note: If question is silent, Method-1 is the preferred treatment

Method-2 Effect is given to the net increase or decrease in goodwill

Topic – 3 | ACCOUNTING OF RESERVES, ACCUMULATED PROFITS / LOSSES:

Study Material & Notes

Study Material & Notes for the Chapter 3

Partnership – Change in Profit Sharing Ratio

III. ACCOUNTING OF RESERVES, ACCUMULATED PROFITS / LOSSES

- On reconstitution of partnership Firm, the partners scans Firm’s Financial position (Balance Sheet) i.e. Reserves, Accumulated Losses, Assets & Liabilities

- The logic behind this exercise is the new relationship should not get undue benefit due to previously earned/unearned profits or suffer loss due to previous earned/unearned losses.

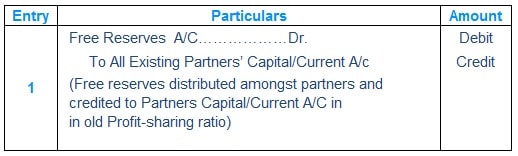

- During this scanning process Partners may find Free Reserves like General Reserve, P&L (Cr), these are distributed among partners in their existing profit-sharing ratio.

- Specific purpose reserves like (a) Workmen Compensation Reserve are compared with any workmen claim (b) Investment Fluctuation Reserve is compared with market value of Investments and any excess reserve is distributed to existing partners in their current PSR and any short reserve is taken to Revaluation A/c.

- Partners may also find Undistributed Losses or Fictitious Assets, these are written off and charged to the existing Partners in their current Profit Sharing Ratio.

- Partners reevaluate market value of Fixed Assets and remeasure Current Assets and Current Liabilities. Any change in the value of Assets/Liabilities is dealt via Revaluation Account and the resultant gain/loss is shared amongst the existing partners in their current profit-sharing ratio.

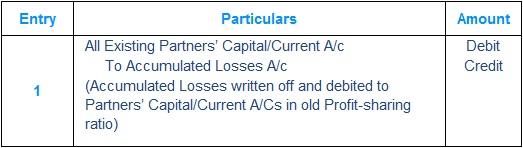

A. Accounting treatment of Accumulated Losses

Accumulated Losses include

- Debit balance in Profit & Loss A/C

- Deferred revenue Expenses

- Preliminary Expenses

- Advertisement Suspense A/C

Method-1 Accumulated Losses are written off

Important to Note: If question is silent, Method-1 is the preferred treatment

Method-2 Accumulated Losses are carried forward

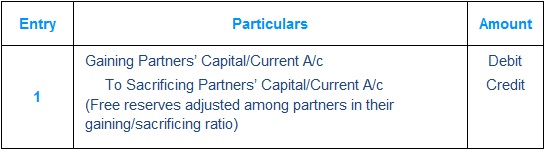

B. Accounting treatment of Free Reserves

Free Reserves include

- Credit balance in Profit & Loss A/C

- General Reserve

- Accumulated Profits

- Contingency Reserve

Method-1 Reserves are distributed amongst partners

Important to Note: If question is silent, Method-1 is the preferred treatment

Method-2 Accumulated Losses are carried forward

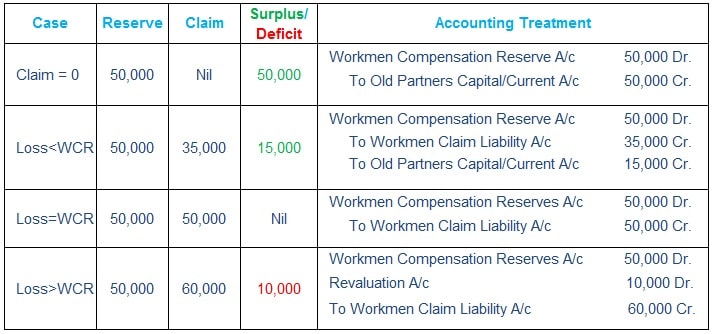

C. Workmen Compensation Reserve

- All good firms take necessary safety precautions and train their workmen to avoid any accidents

- At the factories/workplace despite all safety precautions and training there may be a situation wherein a worker might meet an accident resulting into medical treatment or disability.

- Since the accident taken place at the Firm’s premises, there is a claim from the workmen/employee

- To meet such contingencies, good firms generally set aside funds and create specific reserve Workmen Compensation Reserve

- Any claim from workmen is paid out of the Workmen Compensation Reserve

Accounting Treatment under various scenarios

D. Investments Fluctuation Reserve

- In case a firm has surplus funds, which are not be used in business immediately, invests these funds.

- The Market value of the investments is not static and keeps on varying (higher/lower) due to various economic conditions

- To protect from the risk of any loss due to fall in the value of investments, Good firms set aside reserve out of profits and create Investment Fluctuations Reserve

- In case of a permanent fall in the value of Investments, Firm utilize Investment Fluctuation Reserve

- Any excess Investment Fluctuation Reserve at the time of change in PSR is distributed amongst Partners’ in their old PSR

Accounting Treatment under various scenarios

Topic – 4 | REVALUATION OF ASSETS / LIABILITIES:

Study Material & Notes

Study Material & Notes for the Chapter 3

Partnership – Change in Profit Sharing Ratio

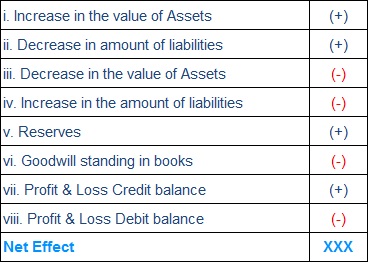

IV. REVALUATION OF ASSETS / LIABILITIES

Partners reevaluate market value of Fixed Assets and remeasure Current Assets and Current Liabilities. Any change in the value of Assets/Liabilities is dealt via Revaluation Account and the resultant gain/loss is shared amongst the existing partners in their current profit-sharing ratio.

Case-1 When Partners decide to show the effect of Revaluation in the Balance Sheet

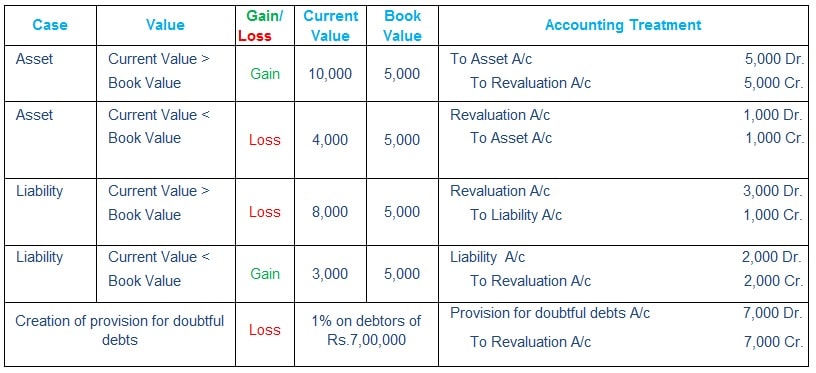

A. Accounting Treatment under various scenarios

- Language in the question: AT/To means new value of the Asset/Liability.

- Language in the question: By means difference between existing value and new value of the Asset/Liability.

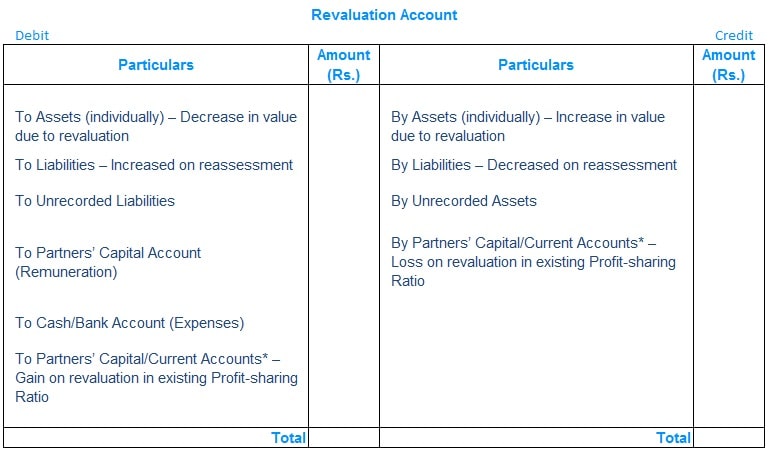

B. Preparation of Revaluation Account

- On the Revaluation of Assets and Reassessment of Liabilities, a new account is opened Revaluation Account

- Revaluation Account is a nominal account. As per nominal rule all the expenses & losses are debited and all the incomes/gains/profits are credited

* Only one will appear at a time

- When Revaluation Account is prepared, assets and Liabilities appear in the Balance Sheet of the reconstituted firm at their revised (changed) values

C. Expenses on reconstitution of the Firm

- Firm gives contract to partner including expenses or excluding expenses

- Treatment when contract to partner is inclusive of expenses

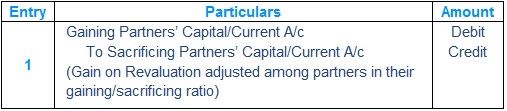

Case-2 When Partners decide to carry old values in the Balance Sheet-Memorandum Revaluation Account

- Applicable when revised (changed) values of assets and liabilities are not to be recorded

- Gain (Profit) or Loss on Revaluation of Assets and Reassessment of Liabilities is adjusted through Capital Accounts by passing an adjustment entry by debiting/crediting the Capital/Current Accounts of gaining partners and crediting/debiting the sacrificing partners

STEPS

b) Calculate Sacrificing/Gaining Ratio = Old Share – New Share

c) Calculate share of Gaining and Sacrificing Partner in the Net Effect (computed in step a)

Topic – 5 | ADJUSTMENT OF CAPITAL:

Study Material & Notes

Study Material & Notes for the Chapter 3

Partnership – Change in Profit Sharing Ratio

V. ADJUSTMENT OF CAPITAL

Applicable when Partners decide that the capitals shall be in their profit-sharing ratio

STEPS

- Compute the new profit-sharing ratio

- Compute partners’ existing capital post adjustment of Revaluation, Reserves Accumulated losses & Goodwill etc.

- Determine firm total capital which is the sum-total of existing capital of all the partners

- Compute the New Capital of each partner by multiplying Total Capital with his new share

- Compare the new capital with existing capital and any shortfall to be brought in and excess is refunded

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Partnership – Admission of Partner

Topic – 1 | ADMISSION – MEANING, NEED AND EFFECTS:

Study Material & Notes

Study Material & Notes for the Chapter 4

Partnership – Admission of a Partner

I. ADMISSION – MEANING, NEED AND EFFECTS

A. Meaning of Admission of a Partner

An existing partnership firm may take up expansion/ diversification of the business. In that case it may need managerial help or additional capital. An option before the partnership firm is to admit partner/partners. When a person is admitted to the existing partnership firm, it is called admission of a partner.

B. Partners Consent

According to the Partnership Act 1932, a person can be admitted into partnership firm only with the consent of all the existing partners unless otherwise agreed upon.

C. Firm Reconstituted

- On admission of a new partner, the old partnership comes to an end and the partnership firm is reconstituted with a new agreement. However the partnership firm continues

- Reconstitution of a firm always leads to change in the existing profit sharing ratio

D. Rights of a new Partner

- Right to share profits in future

- Right to share assets of the firm

Topic – 2 | DETERMINATION OF NEW PROFIT-SHARING RATIO & SACRIFICING RATIO:

Study Material & Notes

Study Material & Notes for the Chapter 4

Partnership – Admission of a Partner

II. DETERMINATION OF NEW PROFIT-SHARING RATIO & SACRIFICING RATIO

A. Adjustment in Profit Sharing Ratio

The new profit-sharing ratio is decided mutually between the existing partners and the new partner. The incoming partner acquires his share of future profits either from one or more existing partner.

B. Sacrificing Ratio

C. Premium For Goodwill

- New partner compensates the existing partners who sacrifice their share of profits in his/her favour.

- The amount new partners pays against this sacrifice is known as Premium For Goodwill

D. Adjustments on Admission

- Adjustment in profit sharing ratio;

- Adjustment of Goodwill;

- Adjustment for revaluation of assets and reassessment of liabilities;

- Distribution of accumulated profits and reserves; and

- Adjustment of partners’ capitals.

E. Sacrificing/(Gaining) Share

Sacrificing/(Gaining) Share = Old Share – New Share

- If a Partner’s Old Share – New Share is Positive (+) figure then the partner has made a sacrifice

- If a Partner’s Old Share – New Share is Negative (-) figure then the partner has made a gain

Case-1 New partner share from old partners is already given – From Case

- In this case, the new profit sharing ratio of the existing partners is to be ascertained after deducting the sacrifice of share agreed from his share. It means the incoming partner has purchased some share of profit in a particular ratio from the existing partners.

- Sacrificing ratio is share surrendered

Case-2 New partner gets his share from existing partners in a particular ratio – OF Case

- In this case, the new profit sharing ratio of the existing partners is to be ascertained after deducting the sacrifice of share agreed from his share. It means the incoming partner has purchased some share of profit in a particular ratio from the existing partners.

- Sacrificing ratio is share surrendered

Case-3 Only new partner share as a portion of firm’s profits is given- Certain Case

- In this case, it is presumed that the existing partners continue to share the remaining profit in the same ratio in which they were sharing before the admission of the new partner. Then, existing partner’s new ratio is calculated by dividing remaining share of the profit in their existing ratio. Sacrificing ratio is calculated by deducting new ratio from the existing ratio.

- Sacrificing ratio is old partners existing ratio

Topic – 3 | PREMIUM FOR GOODWILL:

Study Material & Notes

Study Material & Notes for the Chapter 4

Partnership – Admission of a Partner

III. PREMIUM FOR GOODWILL

A. Why Premium for Goodwill

Accumulated Losses include

The new partner acquires his/her share of profit from the existing partners. This will result in the reduction of the share of existing partners. Therefore, the existing partners asks for Compensation for sacrifice of their profits, he/she compensates the existing partners for the sacrifices this compensation is called Premium for Goodwill. He/she compensates them by making payment in cash or in kind. The payment is equal to his/her share in the goodwill.

B. Premium for Goodwill

Premium for Goodwill = Goodwill of the Firm X New Partner’s Share

If Goodwill is already appearing in the books

- As per Accounting Standard-26 (AS-26), goodwill can be recorded/debited in the books only when some consideration in money or money’s worth has been paid for it. Thus only purchased goodwill should be recorded in the firm’s books

- If at the time of admission of a new partner, goodwill is appearing in the Balance sheet of a firm, it would be desirable to close the Goodwill Account

Journal Entries

C. Premium for Goodwill – Various Scenarios

- All good firms take necessary safety precautions and train their workmen to avoid any accidents

- At the factories/workplace despite all safety precautions and training there may be a situation wherein a worker might meet an accident resulting into medical treatment or disability.

- Since the accident taken place at the Firm’s premises, there is a claim from the workmen/employee

- To meet such contingencies, good firms generally set aside funds and create specific reserve Workmen Compensation Reserve

- Any claim from workmen is paid out of the Workmen Compensation Reserve

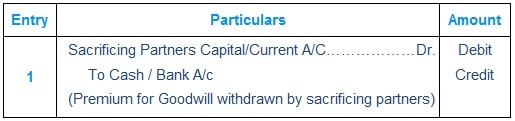

If Premium For Goodwill withdrawn by the existing partners

Journal Entries

Important to Note: The Assets and Liabilities remain at the book value. No adjustment in the Balance Sheet of the revalued assets/liabilities

D. Hidden Goodwill

Firm’s Goodwill = Total Capital – Net Worth

Where:

Total Capital = New Partner’s Capital X Reciprocal of New Partner’s share

Net Worth = Adjusted Existing Partners Capital + New Partner’s Capital

Computation of Net Worth (Liabilities Side Approach) = Existing Partner’s Capital + Free Reserves + Revaluation Profit – Revaluation Loss – Accumulated Losses – Existing Goodwill – Fictitious Assets

Computation of Net Worth (Assets Side Approach) = Total Assets – Outside Liabilities + Revaluation Profit – Revaluation Loss – Accumulated Losses – Existing Goodwill Fictitious Assets

Premium For Goodwill = Goodwill of the Firm X New Partner’ Share

Topic – 4 | ACCOUNTING OF RESERVES, ACCUMULATED PROFITS/LOSSES:

Study Material & Notes

Study Material & Notes for the Chapter 4

Partnership – Admission of a Partner

IV. ACCOUNTING OF RESERVES, ACCUMULATED PROFITS/LOSSES

- On admission of a new partner, the existing partners scans Firm’s Financial position (Balance Sheet) i.e. Reserves, Accumulated Losses, Assets & Liabilities

- The logic behind this exercise is the new partner should not get undue benefit due to previously earned/unearned profits or suffer loss due to previous earned/unearned losses.

- During this scanning process Partners may find Free Reserves like General Reserve, P&L (Cr), these are distributed among existing partners in their current profit-sharing ratio.

- Specific purpose reserves like (a) Workmen Compensation Reserve are compared with any workmen claim (b) Investment Fluctuation Reserve is compared with market value of Investments and any excess reserve is distributed to existing partners in their current Profit-sharing ratio and any short reserve is taken to Revaluation A/c.

- Partners may also find Undistributed Losses or Fictitious Assets, these are written off and charged to the existing Partners in their current Profit-sharing Ratio.

- Partners reevaluate market value of Fixed Assets and remeasure Current Assets and Current Liabilities. Any change in the value of Assets/Liabilities is dealt via Revaluation Account and the resultant gain/loss is shared amongst the existing partners in their current profit-sharing ratio.

A. Accounting treatment of Accumulated Losses

Accumulated Losses include

- Debit balance in Profit & Loss A/C

- Deferred revenue Expenses

- Preliminary Expenses

- Advertisement Suspense A/C

Journal Entry for writing off Accumulated Losses

B. Accounting treatment of Free Reserves

Free Reserves include

- Credit balance in Profit & Loss A/C

- General Reserve

- Accumulated Profits

- Contingency Reserve

Journal Entry for distributed Reserves amongst partners

C. Workmen Compensation Reserve

- All good firms take necessary safety precautions and train their workmen to avoid any accidents

- At the factories/workplace despite all safety precautions and training there may be a situation wherein a worker might meet an accident resulting into medical treatment or disability.

- Since the accident taken place at the Firm’s premises, there is a claim from the workmen/employee

- To meet such contingencies, good firms generally set aside funds and create specific reserve Workmen Compensation Reserve

- Any claim from workmen is paid out of the Workmen Compensation Reserve

Accounting Treatment under various scenarios

D. Investments Fluctuation Reserve

- In case a firm has surplus funds, which are not be used in business immediately, invests these funds.

- The Market value of the investments is not static and keeps on varying (higher/lower) due to various economic conditions

- To protect from the risk of any loss due to fall in the value of investments, Good firms set aside reserve out of profits and create Investment Fluctuations Reserve

- In case of a permanent fall in the value of Investments, Firm utilize Investment Fluctuation Reserve

- Any excess Investment Fluctuation Reserve at the time of change in PSR is distributed amongst Partners’ in their old PSR

Accounting Treatment under various scenarios

E. Revaluation of Assets/ Liabilities

Partners reevaluate market value of Fixed Assets and remeasure Current Assets and Current Liabilities. Any change in the value of Assets/Liabilities is dealt via Revaluation Account and the resultant gain/loss is shared amongst the existing partners in their current profit-sharing ratio.

Accounting Treatment under various scenarios

- Language in the question: AT/To means new value of the Asset/Liability.

- Language in the question: By means difference between existing value and new value of the Asset/Liability.

F. Preparation of Revaluation Account

- On the Revaluation of Assets and Reassessment of Liabilities, a new account is opened Revaluation Account

- Revaluation Account is a nominal account. As per nominal rule all the expenses & losses are debited and all the incomes/gains/profits are credited

Topic – 5 | ADJUSTMENT OF CAPITAL:

Study Material & Notes

Study Material & Notes for the Chapter 4

Partnership – Admission of a Partner

V. ADJUSTMENT OF CAPITAL

- Sometime, at the time of admission, the partners’ agree that their capitals be adjusted in proportion to their profit sharing ratio

- Two methods of Adjustment of Capital

a) Capital of new partner’s is computed in proportion to the total capital of the new firm

b) Adjustment of existing partners capital on the basis of New Partner’s Capital

- For this purpose, the capital accounts of the existing partners are prepared, making all adjustments, on account of goodwill, free reserves , accumulated losses and revaluation of assets/reassessment of liabilities.

- The actual capital so adjusted will be compared with the amount of capital that should be kept in the business after the admission of the new partner.

- The excess if any, of adjusted actual capital over the proportionate capital will either be withdrawn or transferred to current account and vice versa.

- When Revaluation Account is prepared, assets and Liabilities appear in the Balance Sheet of the reconstituted firm at their revised (changed) values

I. Capital of new partner’s is computed in proportion to the total capital of the new firm

-

- The capital accounts of the existing partners are prepared, making all adjustments, on account of goodwill, free reserves , accumulated losses and revaluation of assets/reassessment of liabilities.

- Compute Capital of new partner with reference to Combined Capital of existing partners

II. Capital of new partner’s is computed in proportion to the total capital of the new firm

Step-1 Firm’s Total Capital = New Partner’s Capital X Reciprocal of new partner’s share

Step-2 Specific Partner’s New Capital = Firm’s Total Capital X Specific Partner’s share

Step-3 Specific Partner’s Existing Capital = Old Capital (+)(-) Adjustments of Goodwill, Reserves & Accumulated Losses

Step-4 Capital to be introduced/withdrawn = Specific Partner’s New Capital – Specific Partner’s Existing Capital

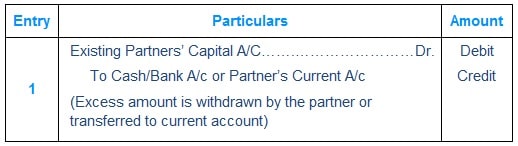

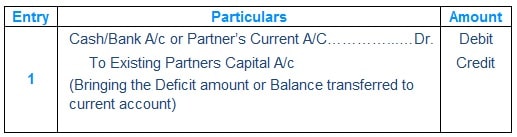

Journal Entries

a) When excess amount is withdrawn by the partner or transferred to current account.

b) For bringing in the Deficit amount or Balance transferred to current account.

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Partnership – Retirement

Topic – 1 | RETIREMENT – MEANING & BASIC CONCEPTS:

Study Material & Notes

Study Material & Notes for the Chapter 6

Partnership – Retirement of Partner

I. RETIREMENT – MEANING AND BASIC CONCEPTS

A. Meaning of Retirement of a Partner

When one or more partners leave the firm and the remaining partners continue to do the business of the firm is called Retirement of a Partner. Retirement of a partner means that the partner ceases to be a partner of the firm. It results in reconstitution of the firm by which old partnership comes to an end and a new partnership among the continuing (remaining) partners comes into existence.

B. Effect

Due to retirement, the existing partnership comes to an end and the remaining partners form a new agreement and the partnership firm is reconstituted with new terms and conditions. At the time of retirement the retiring partner’s claim is settled.

C. Different ways a Partner may retire:

- With the consent of all partners (If all other partners agree to this retirement)

- As per the terms of the agreement (If there is an agreement to that effect…say partner will retire on 31-Mar-2022). The terms and conditions of retirement of a partner are normally provided in the partnership deed. If not, they are agreed upon by the partners at the time of retirement.

- At his/her own will i.e. If he/she has given his/her consent in writing to retire

D. Liability of the Retiring Partner – for the acts before Retirement Section 32(2)

- A retiring partner remains liable for all the acts of the firm up to the date of his retirement.

- However, a retiring partner may be discharged from his liability by an agreement between himself, third party and the continuing partners

E. Liability of the Retiring Partner – for the acts after Retirement Section 32(3)

- A retiring partner also continues to be liable to third parties for the acts of the firm even after his retirement until a public notice of his retirement is given.

- A public notice is served either by way of a notification in the Official Gazette or published in a English & Hindi Newspaper

F. Accounting issues at the time of Retirement

- Determination of New Profit Sharing Ratio and Gaining Ratio

- Adjustment for Goodwill

- Treatment of Reserves & Losses

- Revaluation of assets and liabilities

- Settlement of retiring partner’s dues

- New Capital of the Continuing partners

Topic – 2 | DETERMINATION OF NEW PROFIT SHARING RATIO & GAINING RATIO:

Study Material & Notes

Study Material & Notes for the Chapter 6

Partnership – Retirement of Partner

II. DETERMINATION OF NEW PROFIT-SHARING RATIO & GAINING RATIO

A. Change in Profit-Sharing Ratio

Change in the Profit-sharing ratio is required as the partner who retires surrenders his/her share in favour of the continuing/remaining partners.

B. New Profit-Sharing Ratio

New Profit-Sharing ratio is the ratio in which the continuing/remaining partners decides to the share the profits of the firm in future. It is decided as per the mutual agreement amongst the continuing/remaining partners.

C. Gaining Ratio

At the time of retirement of an existing partner, the remaining or continuing partners acquire the share of profits from the retiring or outgoing partner. The ratio in which remaining partners acquire retiring partner’s profit share is known as gaining ratio.

D. Purpose of Gaining Ratio computation

Gaining ratio is required because the remaining partners will pay the retiring partner’s share of goodwill in their gaining ratio.

E. Gaining/Sacrificing Share

Gaining /(Sacrificing) Share = New Share – Old Share

- If a Partner’s New Share – Old Share is Positive(+) figure then the partner has made a gain

- If a Partner’s New Share – Old Share is Negative(-) figure then the partner has made a sacrifice

F. New Profit Sharing ratio and Gaining/Sacrificing Share

Case-1 Retiring Partner’s Share Distributed in Existing Ratio – Silent on new ratio

- In this case, retiring partner’s share is distributed in existing ratio amongst the remaining partners.

- The remaining partners continue to share profits and losses in the existing

- Gaining Ratio is the existing ratio amongst the remaining partners

Important to Note:

- In absence of any information in the question, it will be presumed that retiring partner’s share has been distributed among the remaining partners in existing (old) ratio

Case-2 Retiring partner’s share distributed in Specified proportion – OF Case

- Sometimes the remaining partners purchase the share of the retiring partner in specified ratio.

- The share purchased by them is added to their old share and the new ratio is arrived at.

- Gaining Ratio is the specified share acquired from the Retiring partner

Case-3 Retiring partner’s share is taken by one of the Partners

- The retiring partner’s share is taken up by one of the remaining partners.

- In this case, the retiring partner’s share is added to that of existing partner’s share. Only his/her share changes.

- The other partners continue to share profit in the existing ratio.

- Gaining Ratio – One partner acquires full share of the Retiring partner

G. Distinction between sacrificing ratio and gaining ratio?

Topic – 3 | VALUATION & ADJUSTMENT OF GOODWILL:

Study Material & Notes

Study Material & Notes for the Chapter 6

Partnership – Retirement of Partner

III. VALUATION AND ADJUSTMENT OF GOODWILL

A. Accounting Treatment of Goodwill

- The retiring partner is entitled to his/her share of goodwill at the time of retirement because the goodwill of the firm has been earned with the efforts of all the existing partners including the retiring partner.

- Hence, at the time of retirement of a partner, goodwill is valued as per agreement among the partners.

- The retiring partner is compensated for his/her share of goodwill by the continuing partners (who have gained due to acquisition of share of profit from the retiring/deceased partner) in their gaining ratio.

- The accounting treatment for goodwill in such a situation depends upon whether or, not goodwill already appears in the books of the firm.

- Therefore, in case of retirement of a partner, the goodwill is adjusted through partner’s capital accounts. The retiring partner’s capital account is credited with. his/her share of goodwill and remaining partner’s capital account is debited in their gaining ratio.

B. When Goodwill is already appearing in the books

- As per Accounting Standard-26 (AS-26), goodwill can be recorded/debited in the books only when some consideration in money or money’s worth has been paid for it.

- Thus only purchased goodwill should be recorded in the firm’s books

- If at the time of retirement of a partner, goodwill is appearing in the Balance sheet of a firm, it would be desirable to close the Goodwill Account

C. Goodwill is not appearing in books and computed-Known Goodwill

Step-1 Firm’s Goodwill = Its given in the question or computed as per valuation methods

Step-2 Goodwill Share of the Retiring Partner = Firm’s Goodwill X Retiring Partner’s share

Step-3 Goodwill Share of the Remaining Partner = Goodwill share of the Retiring Partner X Gaining Ratio

The goodwill is adjusted through partner’s capital accounts. The retiring partner’s capital account is credited with. his/her share of goodwill and remaining partner’s capital account is debited in their gaining ratio.

D. Hidden Goodwill

If the firm has agreed to settle the retiring or deceased partner’s account by paying him a lump sum amount, then the amount paid to him in excess of what is due to him, based on the balance in his capital account after making necessary adjustments in respect of accumulated profits and losses and revaluation of assets and liabilities, etc., shall be treated as his share of goodwill (known as hidden goodwill).

Hidden Goodwill = Total Lumpsum payment to the Retiring partner – Retiring Partner’s adjusted capital balance

Topic – 4 | RESERVES, ACCUMULATED LOSSES & REVALUATION:

Study Material & Notes

Study Material & Notes for the Chapter 6

Partnership – Retirement of Partner

IV. ACCOUNTING TREATMENT OF RESERVES, ACCUMULATED PROFITS, REVALUATION

- On retirement of a partner, the partners scans Firm’s Financial position (Balance Sheet) i.e. Reserves, Accumulated Losses, Assets & Liabilities.

- As learnt in case of Admission of partner, this is done to ensure no partner(s) get(s) undue benefit due to previously earned/unearned profits or suffer loss due to previous earned/unearned losses.

- Free Reserves like General Reserve, P&L (Cr), these are distributed among partners in their existing profit-sharing ratio.

- Specific purpose reserves like (a) Workmen Compensation Reserve are compared with any workmen claim (b) Investment Fluctuation Reserve is compared with market value of Investments and any excess reserve is distributed to existing partners in their current PSR and any short reserve is taken to Revaluation A/c.

- Any Undistributed Losses or Fictitious Assets are written off and charged to the existing Partners in their current Profit Sharing Ratio.

- Partners reevaluate market value of Fixed Assets and remeasure Current Assets and Current Liabilities. Any change in the value of Assets/Liabilities is dealt via Revaluation Account and the resultant gain/loss is shared amongst the existing partners in their current profit-sharing ratio.

Topic – 5 | ACOMPUTATION & METHOD OF PAYMENT TO RETIRING PARTNER:

Study Material & Notes

Study Material & Notes for the Chapter 6

Partnership – Retirement of Partner

V. PAYMENT TO RETIRING PARTNER

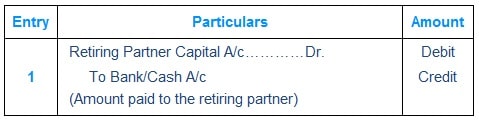

A. Computation of Amount Due to the Retiring Partner

B. Settlement of Retiring Partner’s Claim – In Lumpsum

Retiring partners’ claim is paid either out of the funds available with the firm or out of funds brought in by the remaining partners.

C. Settlement of Retiring Partner’s Claim – In Installments

- Amount due to retiring partner is paid in instalments. Usually, some amount is paid immediately on retirement and the balance is transferred to his loan account.

- This loan is paid in one or more instalments and the loan amount carries some interest.

- In the absence of any agreement on interest rate, the retiring partner can claim interest @ 6% [as per Section 37 of the Indian Partnership Act 1932]

- Installment has two parts – Principal Amount of Loan and Interest at agreed rates

- Interest due on loan amount is credited to retiring partners’ loan account.

- Instalment inclusive of interest then is paid to the retiring partner as per schedule agreed upon.

D. Mid Term Retirement

- Mid term retirement categorize the adjustments in two parts

- From previous balance sheet date

- Examples: Goodwill, Reserves, Undistributed Profits/Losses Misc. Expenditure on Assets side, revaluation Profit/Loss etc.

- There is no change in these values if partner retires mid term

- Period specific adjustments

- Examples: like Salary, Drawings, Interest on Capital, Interest on Drawings, share of current account year profit/loss.

- In such adjustments, time factor is used.

- The Estimated Profit/Loss till the date of retirement is credited/debited to the Retiring partner A/c

- From previous balance sheet date

- Mid Term Retirement-Interest payment to Retiring Partner

-

- Interest is accrued on (i) End of the Financial year and (ii) Date of Payment

- Installment is paid on date of payment along with interest

-

Topic – 6 | ADJUSTMENT OF CAPITALS:

Study Material & Notes

Study Material & Notes for the Chapter 6

Partnership – Retirement of Partner

VI. ADJUSTMENT OF CAPITAL

- Sometime, at the time of retirement, the remaining partners’ agree that their capitals be adjusted

- To begin with, New Capital of the reconstituted Firm is determined

- The partners may decide to keep the New Capital at the same level as it was there in the business before retirement of partner or decide a lump-sum figure

- New Capital can be equal to combined adjusted closing capital of remaining partners or with addition towards shortage of the amount payable to retiring partner + desired cash balance to be maintained in business

- For this purpose, the capital accounts of the existing partners are prepared, making all adjustments, on account of goodwill, free reserves , accumulated losses and revaluation of assets/reassessment of liabilities.

- The actual capital so adjusted will be compared with the amount of capital that should be kept in the business after the admission of the new partner.

- The excess if any, of adjusted actual capital over the proportionate capital will either be withdrawn or transferred to current account and vice versa.

Methods of Capital Adjustment

I. When Total Capital of the New Firm is Given

Step-1 Firm’s Total Capital = Given in the Question already

Step-2 Specific Partner’s New Capital

= Firm’s Total New Capital (as per Step-1) X Specific Partner’s Share per new PSR

Step-3 Specific Partner’s Existing Adjusted Closing Capital

= Old Capital +(-) Adjustments of Goodwill, Reserves & Accumulated losses

Step-4 Capital to be introduced/ withdrawn

= Specific Partner’s New Capital – Specific Partner’s Existing Adjusted Closing Capital

II. When Total Capital of the Remaining Partners is to be in their New Profit-Sharing Ratio

Step-1 Firm’s Total Capital = Combined Adjusted Closing Capital of remaining partners

Step-2 Specific Partner’s New Capital

= Firm’s Total New Capital (as per Step-1) X Specific Partner’s Share per new PSR

Step-3 Specific Partner’s Existing Adjusted Closing Capital

= Old Capital +(-) Adjustments of Goodwill, Reserves & Accumulated losses

Step-4 Capital to be introduced/ withdrawn

= Specific Partner’s New Capital – Specific Partner’s Existing Adjusted Closing Capital

III. When Total Capital of New Firm is equal to Total Capital before retirement of a partner

Step-1 Firm’s Total Capital = Total Capital of all the Partners including retiring partner before adjustments (as per Balance Sheet given)

Step-2 Specific Partner’s New Capital

= Firm’s Total New Capital (as per Step-1) X Specific Partner’s Share per new PSR

Step-3 Specific Partner’s Existing Adjusted Closing Capital

= Old Capital +(-) Adjustments of Goodwill, Reserves & Accumulated losses

Step-4 Capital to be introduced/ withdrawn

= Specific Partner’s New Capital – Specific Partner’s Existing Adjusted Closing Capital

IV. When the Retiring Partner is paid through amount brought by the remaining partners in a manner to make their capitals proportionate to their New Profit-sharing Ratio

Step-1 Firm’s Total Capital = Combined adjusted closing capital + Shortage of the amount to be paid to retiring partner

Step-2 Specific Partner’s New Capital

= Firm’s Total New Capital (as per Step-1) X Specific Partner’s Share per new PSR

Step-3 Specific Partner’s Existing Adjusted Closing Capital

= Old Capital +(-) Adjustments of Goodwill, Reserves & Accumulated losses

Step-4 Capital to be introduced/ withdrawn

= Specific Partner’s New Capital – Specific Partner’s Existing Adjusted Closing Capital

V. When the Retiring Partner is to be paid through amount brought by the Remaining partners in a manner to make their Capitals proportionate to their New Profit-sharing Ratio and also leave a desired Cash Balance

Step-1 Firm’s Total Capital = Combined adjusted closing capital + Shortage of the amount to be paid to retiring partner + Desired Cash balance

Step-2 Specific Partner’s New Capital

= Firm’s Total New Capital (as per Step-1) X Specific Partner’s Share per new PSR

Step-3 Specific Partner’s Existing Adjusted Closing Capital

= Old Capital +(-) Adjustments of Goodwill, Reserves & Accumulated losses

Step-4 Capital to be introduced/ withdrawn

= Specific Partner’s New Capital – Specific Partner’s Existing Adjusted Closing Capital

Journal Entries

a. When excess amount is withdrawn by the partner or transferred to current

a. When excess amount is withdrawn by the partner or transferred to current

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Partnership – Death of a Partner

Topic – 1 | Concepts and New Profit-Sharing Ratio:

Study Material & Notes

Study Material & Notes for the Chapter 7

Partnership – Death of a partner

I. DEATH OF A PARTNER – BASIC CONCEPTS

A. Meaning of Death of a Partner

- Death of a partner is a compulsory retirement

- Death of a partner may occur any time unlike the retirement which normally takes place at the end of an accounting period.

B. New Profit-Sharing Ratio

New Profit-Sharing ratio is the ratio in which the continuing/remaining partners decides to the share the profits of the firm in future. It is decided as per the mutual agreement amongst the continuing/remaining partners.

C. Gaining Ratio:

The ratio in which remaining partners acquire retiring partner’s profit share is known as gaining ratio.

Topic – 2 | Share of Profit/Loss till Partner’s Death:

Study Material & Notes

Study Material & Notes for the Chapter 7

Partnership – Death of a partner

II. CALCULATION OF PROFIT UP TO THE DATE OF DEATH OF A PARTNER

If the death of a partner occurs during the year, the representatives of the deceased partner are entitled to his/her share of profits earned till the date of his/her death. Such profit is ascertained by any of the following methods

- Time Basis

- Turnover or Sales basis

A. Calculation of Profit up to the Date of Death of a Partner – Time Basis

It is computed either on Previous Year Profit or Average Profit

Deceased Partner’s Share of Profits = Previous Year Profit X Time Till Death X Deceased Partner’s Share

12 or 365

Or

Deceased Partner’s Share of Profits = Average Profit X Time Till Death X Deceased Partner’s Share

Where, Average Profit = Total Profit

12 or 365

No. of Years

B. Calculation of Profit up to the Date of Death of a Partner – Sales or Turnover Basis

Deceased Partner’s Share of Profits = Last Year Profit X Sales Till Death X Deceased Partner’s Share

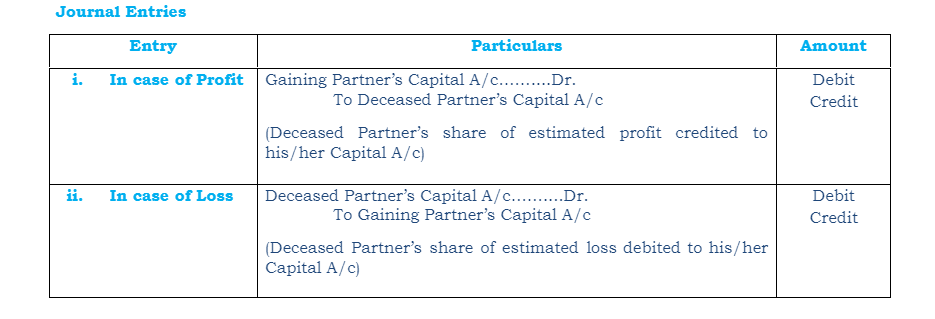

C. Accounting Treatment of Deceased Partner’s share in Profits

a) Through Profit & Loss Suspense Account – When New Profit-Sharing Ratio of the continuing partners does not differ from Old Profit-Sharing Ratio

b) Through Capital Transfer – When New Profit-Sharing Ratio of the continuing partners differs from Old Profit-Sharing Ratio

Topic – 3 | Amount Due to Legal Representative:

Study Material & Notes

Study Material & Notes for the Chapter 7

Partnership – Death of a partner

III. AMOUNT DUE TO LEGAL REPRESENTATIVE

A. Accounting Treatment

On the death of a partner, the accounting treatment regarding goodwill, revaluation of assets and reassessment of liabilities, accumulated reserves and undistributed profit are similar to that of the retirement of a partner.

B. Payment of Dues

On the death of a partner his/her claim is transferred to his/her executors or legal representatives and settled in the same manner as that of the retired partner.

C. Computation of Amount Due to the Legal Representative

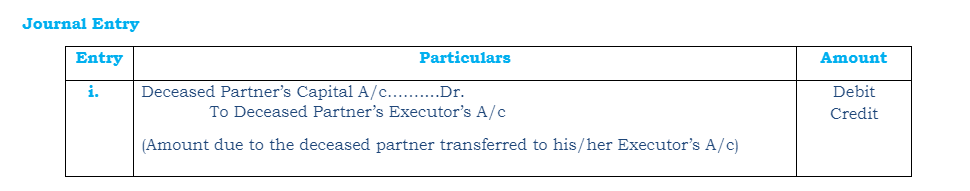

The above adjustments are made in the capital account of the deceased partner and then the balance in the capital account is transferred to an account opened in the name of his/her executor

The payment of the amount of the deceased partner depends on the agreement. In the absence of an agreement, the legal representative of a deceased partner is entitled to interest @ 6% p.a. on the amount due from the date of death till the date of final payment

D. Deceased Partner’s Capital Account

Topic – 4 | Settlement of Executor’s Claim:

Study Material & Notes

Study Material & Notes for the Chapter 7

Partnership – Death of a partner

IV. SETTLEMENT OF EXECUTOR’S CLAIM

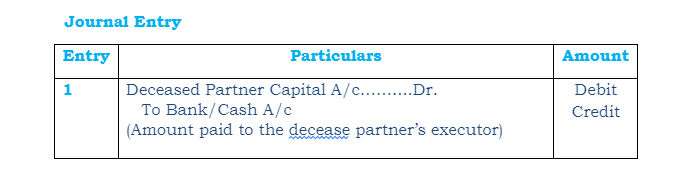

A. Settlement of Deceased Partner’s Executor’s Claim – In Lumpsum

Deceased partners’ executor’s claim is paid either out of the funds available with the firm or out of funds brought in by the remaining partners.

B. Settlement of Deceased Partner’s Executor’s Claim – In Installments

- Amount due to deceased partner’s executor is paid in instalments. Usually, some amount is paid immediately and the balance is transferred to his loan account.

- This loan is paid in one or more instalments and the loan amount carries some interest.

- In the absence of any agreement on interest rate, the retiring partner can claim interest @ 6% [as per Section 37 of the Indian Partnership Act 1932]

- Installment has two parts – Principal Amount of Loan and Interest at agreed rates

- Interest due on loan amount is credited to deceased partners’ executor’s loan account.

- Instalment inclusive of interest then is paid to the deceased partner’s executor as per schedule agreed upon.

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Partnership – Dissolution of a Partnership Firm

Topic – 1 | Dissolution of Partnership –Basic Concepts:

Study Material & Notes

Study Material & Notes for the Chapter 7

Partnership – Dissolution of Partnership

I. DISSOLUTION OF PARTNERSHIP –BASIC CONCEPTS

A. Meaning of Dissolution of Firm

- According to Section 39 of the Partnership Act 1932, the dissolution of partnership between all the partners of a firm is called the dissolution of the firm.

- It is the breaking or discontinuance of relationship between all the partners which is termed as the dissolution of partnership firm.

- This brings an end to the existence of firm, and no business is transacted after dissolution except the activities related to closing of the firm. As the affairs of the firm are to be wound up by selling firm’s assets and paying its liabilities and discharging the claims of the partners.

B. Meaning of Dissolution of Partnership

Dissolution of a partnership means termination of old partnership agreement and a reconstitution of firm due to admission, retirement and death of a partner. In dissolution of a partnership the remaining partners may agree to carry on the business under a new agreement.

C. Distinction between Dissolution of Partnership and Dissolution of Firm:

Basis | Dissolution (Reconstitution) of Partnership | Dissolution of Partnership Firm |

Meaning | Dissolution of partnership means change in existing relations of the partners. The firm continues its business. | Dissolution of a firm means the dissolution of partnership among all the partners of the firm and the firm’s business is closed |

Closure of books | It does not require closure of books of account because business is not closed. | Books of Account are closed as the business is closed |

Court’s Intervention | Court does not intervene because partnership is dissolved by mutual agreement | A firm may be dissolved by court order |

Settlement of assets and liabilities | Assets are revalued and liabilities are reassessed | All the Assets other than cash are realized and liabilities are paid |

Economic Relationship | Economic relationship between the partners changes | Economic relations between the partners comes to an end |

Continuity of business | Business of the firm continues | Business of the firm comes to an end |

Effect | Dissolution of partnership may or may not involve dissolution of firm | Dissolution of firm also means dissolution of partnership |

D. MODES OF DISSOLUTION OF PARTNERSHIP

1) MODES OF DISSOLUTION OF PARTNERSHIP

- all the partners give consent

- as per the terms of the partnership agreement

2) Compulsory Dissolution

- When all the partners or all excepting one partner becomes insolvent or of unsound mind.

- When business of the firm becomes illegal

3) On Happening of an Event or Contingent Dissolution–

- On expiry of the term for which the firm was constituted

- On completion of the venture

- On the death of a partner

- On adjudication of a partner as insolvent

4) By Notice

In case of a partnership at will, the firm may be dissolved if any one of the partner gives a notice in writing to the other partners.

5) Dissolution By Court – Court may pass Order for the dissolution when

- A Partner becomes a person of unsound mind

- A partners becomes permanently incapable of performing his/her duties as a Partner

- A partner is guilty of misconduct which is likely to adversely affect the business of the firm;

- A partner persistently commits breach of partnership agreement;

- A partner transfers his/her interest in the firm to a third party;

- The business of the firm cannot be carried on except at a loss

- The court regards dissolution to be just and equitable.

E. Settlement of Accounts on Dissolution of a Partnership Firm (Sec 48)

- In case of dissolution of a firm, the firm ceases to conduct business and has to settle its accounts. For this purpose, it disposes off all its assets for satisfying all the claims against it.

- In this context it should be noted that, subject to agreement among the partners, the following rules as provided in Section 48 of the Partnership Act 1932 shall apply.

(a) Treatment of Losses:-

Losses, including deficiencies of capital, shall be paid :

(i) first out of profits,

(ii) next out of capital of partners, and

(iii) lastly, if necessary, by the partners individually in their profits sharing ratio.

(b) Application of Assets

The assets of the firm, including any sum contributed by the partners to make up deficiencies of capital, shall be applied in the following manner and order:

(i) In paying the debts of the firm to the third parties;

(ii) In paying each partner proportionately what is due to him/her from the firm for advances as distinguished from capital (i.e. partner’ loan);

(iii) In paying to each partner proportionately what is due to him on account of capital; and

iv) the residue, if any, shall be divided among the partners in their profit sharing ratio.

F. Firm Debt and Private Debts (Sec 49)

Where both the debts of the firm and private debts of a partner co-exist, the following rules, as stated in Section 49 of the Act, shall apply.

- The property of the firm shall be applied first in the payment of debts of the firm and then the surplus, if any, shall be divided among the partners as per their claims, which can be utilised for payment of their private liabilities.

- The private property of any partner shall be applied first in payment of his private debts and the surplus, if any, may be utilised for payment of the firm’s debts, in case the firm’s liabilities exceed the firm’s assets.

Firm’s Debts | Private Debts |

Debts owned by the firm to the outsiders | Debts owned by a partner in his/her personal capacity e.g. Home Loan fm Bank |

Utilization of Firm’s Property | Utilization of Partner’s Property |

(a) Firm’s Debts | (a) Private Debts |

(b) Private Debts | (b) Firm’s Debts |

Topic – 2 | Accounting Treatment on Dissolution -Realisation A/c:

Study Material & Notes

Study Material & Notes for the Chapter 7

Partnership – Dissolution of Partnership

II. ACCOUNTING TREATMENT ON DISSOLUTION OF PARTNERSHIP

Accounts to be prepared

- Realisation Account

- Partner’s Loan Account

- Partner’s Capital Accounts

- Cash or Bank Account

A. Realisation Account

- When the firm is dissolved it becomes necessary to settle its liabilities and dispose off its assets. The residual, if any, is taken by the partners to their home.

- For this purpose, a separate account called ‘Realisation Account’ is opened. All the Asset accounts (excluding Cash in hand/at bank and Fictitious assets) are closed and transferred at their book value debiting Realisation Account.

- Similarly, all the external Liabilities accounts are closed and transferred at their book value crediting Realisation Account.

- Amount realised from the sale of assets is credited and amount paid towards discharge of liabilities is debited to the Realisation account

- Expenses on Realisation/dissolution are debited to this account

- Realisation is a nominal Account. Excess of Credit over Debit is the profit on Realisation and is credited to Partners Capital Accounts in their profit-sharing ratio and vice versa.

- If realized value of any asset is not given it means its Realisation value is zero

- If settlement value of any liability is not provided it means it is paid at book value

Treatment of Balance Sheet Items

Balance Sheet

|

Liabilities |

Treatment |

Assets |

Treatment |

|

Partners’ Capital/Current Account |

Partners’ Capital |

Goodwill |

Realisation |

|

General Reserve/Profit & Loss A/c |

Partners’ Capital |

Land & Buildings |

Realisation |

|

Workmen Compensation Reserve |

Various scenarios |

Plant & Machinery |

Realisation |

|

Investment Fluctuation Reserve |

Realisation |

Cash & Bank |

Separate A/c |

|

Creditors/Bills Payable |

Realisation |

Stock, Prepaid Exp |

Realisation |

|

Partners’ Loan Accounts |

Separate A/c |

Debtors |

Realisation |

|

Partners’ Relative Loan Accounts |

Realisation |

Provision for doubtful debts |

Realisation |

|

Bank Loan/Bank Overdraft |

Realisation |

Investments |

Realisation |

|

Provident Fund/Pension Payable |

Realisation |

Fictitious Assets |

Partners’ Capital |

|

Income Received in Advance |

Realisation |

Profit & Loss (Dr. Balance) |

Partners’ Capital |

Journal Entries

Transaction | Entry | Amount |

| Realisation A/c……….Dr. To Respective Assets A/c (Assets transferred to Realisation A/c) | Debit Credit |

| Respective Liabilities A/c……….Dr. To Realisation A/c (Liabilities transferred to Realisation A/c) | Debit Credit |

| Cash A/c……….Dr. To Realisation A/c (Amount realised on sale of assets) | Debit Credit |

| Respective Partner’s Capital A/c……….Dr. To Realisation A/c (Asset taken over by Partner) | Debit Credit |

| Realisation A/c……….Dr. To Cash/Bank A/c (Settlement of liabilities in cash) | Debit Credit |

| Realisation A/c……….Dr. To Respective Partner’s Capital A/c (Liability taken over by Partner) | Debit Credit |

| No Entry | |

| Realisation A/c……….Dr. To Cash/Bank A/c (Settlement of liabilities in cash) | Debit Credit |

| Cash/Bank A/c……….Dr. To Realisation A/c (Amount realised on sale of assets) | Debit Credit |

| Realisation A/c……….Dr. To Partners’ Capital A/c (Profit on Realisation transferred to Partners Capital A/c) | Debit Credit |

| Partners’ Capital A/c……….Dr. To Realisation A/c (Loss on Realisation transferred to Partners Capital A/c) | Debit Credit |

- If Realisation of any tangible/intangible is not mentioned in the question, its realizable value is deemed as nil

- If settlement value of any liability is not mentioned in the question, it is deemed to be settled at book value

- Any Provision/Fund against the asset is also transferred to Realisation A/c e.g. Provision for Depreciation, Bad debts, Discount on Debtors or Investments Fluctuation Fund

Balance Sheet

Dr. Cr.

Particulars | Amount | Particulars | Amount |

To All Asset A/c (Except Cash/Bank) To Cash/Bank A/c (Payment of external liabilities) To Partners’ Capital A/cs (Liability paid by partners) To Cash/Bank A/c (Expenses on Realisation) To Partners’ Capital A/cs (Realisation exp paid by Partner) To Partners’ Capital A/cs (Transferring profit on Realisation) | Book Value | By All Outside Liabilities A/c By Cash/Bank A/c (Amount realized on sale of assets) By Partners’ Capital A/cs (Assets taken over by partners) By Partners’ Capital A/cs (Transferring loss on Realisation)

| Book Value |

Topic – 3 | Accounting Treatment on Dissolution –Capital, Loan & Cash:

Study Material & Notes

Study Material & Notes for the Chapter 7

Partnership – Dissolution of Partnership

III. ACCOUNTING TREATMENT ON DISSOLUTION OF PARTNERSHIP

2(A) Loan Given by Firm to Partner

- A firm may have given to Loan to a partner

- Loan Given to a Partner is an Asset

- On Dissolution Loan given to a Partner is closed and transferred to respective Partner’s capital A/c

Journal Entries

|

Transaction |

Entry |

Amount |

|

When Partner has either credit or debt Balance in his/her Capital A/c |

Partner’s Capital A/c……….Dr. To Loan To Partner A/c (Partner Loan A/c is transferred to Partner’s Capital A/c) |

Debit Credit |

Loan to Partner Account

Dr. Cr.

|

Particulars |

Amount |

Particulars |

Amount |

|

To Balance b/d |

By Partner’s Capital A/c |

||

|

Total |

Total |

2 (B) Loan Given by Partner to Firm

- A firm may have received Loan from a partner

- Loan from a Partner is not an Outside Liability hence it is not transferred to the Realisation A/c

- Accounting treatment for Loan received from Partner’s is to first close the Partner Capital A/c making all adjustments related to transfer of Free reserves, Fictitious assets, Assets/liabilities taken over, Profit/Loss on realisation etc.

- Treatment of Loan given by a partner depends on the balance in partner’s capital account at this stage:

- If Partner has Credit balance in his/her Capital A/c, balance in his/her Loan A/c is repaid in cash

- If Partner has Debit balance in his/her Capital A/c, balance in his/her Loan A/c is transferred to his/her Capital A/c

Journal Entries

Transaction | Entry | Amount |

(i) When Partner has credit Balance in his/her Capital A/c | Partner’s Loan A/c……….Dr. To Cash/Bank A/c (Repayment of Partner’s Loan A/c by cash) | Debit Credit |

(ii) When Partner has debit balance in his/her Capital A/c | Partners’ Loan A/c……….Dr. To Partner’s Capital A/c (Partner’s Loan transferred to Partner’s Capital A/c) | Debit Credit |

Loan to Partner Account

Dr. Cr.

|

Particulars |

Amount |

Particulars |

Amount |

|

To Bank or Partner’s Capital A/c |

By Balance b/d |

||

|

Total |

Total |

3 Partner’s Capital Accounts

After all the adjustments related to partners’ capital accounts and transfer of profit or loss on realisation to the partners’ capital accounts, the capital accounts are closed in the following manner:

Partner’s Capital Account

Dr. Cr.

|

Particulars |

Amount |

Particulars |

Amount |

|

To Fictitious Assets/Undistributed Losses A/c To Realisation A/c (Assets taken over) To Partner’s Loan A/c To Partner’s Current A/c (Debit balance) To Realisation A/c (Loss) To Cash/Bank A/c (Surplus in Capital A/c) |

By Balance b/d By Reserves/Accumulated Profits By Realisation A/c (Liabilities taken over) By Partner’s Current A/c (Credit balance) By Partner’s Loan A/c By Realisation A/c (Expenses) By Realisation A/c (Gain) By Cash/Bank A/c (Deficit in Capital A/c) |

||

|

Total |

Total |

Journal Entries

Transaction | Entry | Amount |

(i) In case of Surplus i.e. Credit balance, the partner needs to be paid off balance in his/her account in cash | Partner’s Capital A/c……….Dr. To Cash/Bank A/c (Cash paid to Partner) | Debit Credit |

(ii) In case of Deficit i.e. Debit balance e partner, the partner needs to be bring in balance in his/her account in cash | Cash/Bank A/c……….Dr. To Partner’s Capital A/c (Cash brought-in by the Partner) | Debit Credit |

4 Cash Account

Cash Account

Dr. Cr.

|

Particulars |

Amount |

Particulars |

Amount |

|

To Balance b/d To Realisation A/c (sale of assets) To Cash A/c (if both Cash & Bank A/cs) To Partner Capital A/c (settlement) |

By Realisation A/c (payment of liabilities) By Realisation A/c (expenses) By Partner Loan A/c (repayment) By Realisation A/c (Bank overdraft) By Partner Capital A/c (settlement) |

||

|

Total |

Total |

Journal Entries

Transaction | Entry | Amount |

(i) For Cash deposited into Bank | Bank A/c……….Dr. To Cash A/c (Cash deposited into Bank) | Debit Credit |

((ii) For Cash withdrawn from Bank | Bank A/c……….Dr. To Cash A/c (Cash withdrawn from Bank) | Debit Credit |

Journal Entries

Transaction | Entry | Amount |

(i) In case of Surplus i.e. Credit balance, the partner needs to be paid off balance in his/her account in cash | Partner’s Capital A/c……….Dr. To Cash/Bank A/c (Cash paid to Partner) | Debit Credit |

(ii) In case of Deficit i.e. Debit balance e partner, the partner needs to be bring in balance in his/her account in cash | Cash/Bank A/c……….Dr. To Partner’s Capital A/c (Cash brought-in by the Partner) | Debit Credit |

If both Cash A/c as well Bank A/c are given in the question, assume Cash is deposited into Bank. Pass the journal entry & do Ledger posting accordingly.

Treatment of Workmen Compensation Reserve and Claim

- Payment of Workmen Claim in all the cases is routed through Realisation A/c

- Workmen Compensation Reserve to the extent of Workmen Claim is transferred to Realisation A/c

- Workmen Compensation Reserve in excess of Workmen Claim is distributed to Partner’s Capital A/c

Reserve | Claim | Journal Entry | Amount |

Yes | No | Workmen Compensation Reserve A/c………Dr To All Partners Capital A/c (in their PSR) | Reserve Amount Reserve Amount |

No | Yes | Realisation A/c………………………………………….Dr. To Cash/Bank A/c | Claim Amount Claim Amount |

Yes | Yes | Realisation A/c………………………………………… Dr. | Claim Amount |

Claim>WCR | To Cash/Bank A/c | Claim Amount | |

Workmen Compensation Reserve A/c………Dr. To Realisation A/c | Reserve Amount Reserve Amount | ||

Yes | Yes | Realisation A/c………………………………………… Dr. | Claim Amount |

Claim<WCR | To Cash/Bank A/c | Claim Amount | |

Workmen Compensation Reserve A/c………Dr To Realisation A/c To All Partners Capital A/c (in their PSR) | Reserve Amount Claim Amount Reserve – Claim | ||

- WCR in excess of Workmen Claim is distributed to Partner’s Capital A/c

Treatment of Workmen Compensation Reserve and Claim

Situation | Type | Born by | Paid by | Journal Entry |

Dissolution expenses borne and paid by the Firm | Expenses | Firm | Firm | Realisation A/c…………………Dr. To Cash/Bank A/c |

Expenses borne by firm and paid by Partner | Expenses | Firm | Partner | Realisation A/c…………………Dr. To Partner’s Capital A/c |

Firm gives contract to Partner (including expenses) | Remuneration | Firm | Due to Partner | Realisation A/c…………………Dr. To Partner’s Capital A/c |

Expenses | Partner | Partner | No Entry | |

Expenses | Partner | Firm | Partner’s Capital A/c……………Dr. To Cash/Bank A/c | |

Firm gives contract to Partner (excluding expenses or question is silent on who paid) | Remuneration | Firm | Due to Partner | Realisation A/c…………………Dr. To Partner’s Capital A/c |

Expenses | Firm | Partner | Realisation A/c…………………Dr. To Cash/Bank A/c | |

Expenses | Firm | Partner | Realisation A/c……………Dr. To Partner’s Capital A/c | |

Expenses borne by firm and paid by Partner | Expenses | One Partner | Another Partner | Partner’s Capital A/c…………Dr. (Bearing expenses) To Partner’s Capital A/c (Paying expenses) |

Topic – 4 | Memorandum Balance Sheet:

Study Material & Notes

Study Material & Notes for the Chapter 7

Partnership – Dissolution of Partnership

IV. Memorandum Balance Sheet

- If Balance Sheet is not provided in the question a Memorandum Balance Sheet needs to be prepared.

- Whatever items of Assets, Liabilities, Reserves & Partner’s Capital with their respective amounts is provided in the question is put up in the Memorandum Balance Sheet.

- In the Memorandum Balance Sheet so prepared, the total of Liabilities side may not match with total of Assets side.

- The balancing figure represents the amount of any missing asset/liability/reserve

- If Liabilities > Assets the missing item is assumed to be Sundry Assets and

- if Assets > Liabilities the missing item is assumed to be Profit & Loss account

- Once Memorandum Balance Sheet is ready, Realisation A/c is prepared and the remaining steps for closure of various accounts are same.