Class 11th Chapters

- 7. Origin of Transactions-Source documents & Preparation of Vouchers

- 8. Journal

- 9. Ledger

- 10. Special Purpose Books-I Cash Book

- 11. Special Purpose Books-II Other Books

- 12. Accounting for Goods & Services Tax (GST)

- 13. Bank Reconciliation Statement

Bank Reconciliation Statement

Topic – 1 | FINANCIAL STATEMENTS ANALYSIS

Study Material & Notes

Study Material & Notes for the Chapter 11

Financial Statements Analysis & Tools

I. FINANCIAL STATEMENT ANALYSIS

i. Meaning of Financial Statement Analysis

- Financial statement analysis is a judgemental process which aims to estimate current and past financial positions and the results of the operation of an enterprise, with primary objective of determining the best possible estimates and predictions about the future conditions.

- It essentially involves regrouping and analysis of information provided by financial statements to establish relationships and throw light on the points of strengths and weaknesses of a business enterprise, which can be useful in decision-making involving comparison with other firms (cross sectional analysis) and with firms’ own performance, over a time period (time series analysis).

- The term ‘financial analyses includes both ‘analysis and interpretation’. The term analysis means simplification of financial data by methodical classification given in the financial statements. Interpretation means explaining the meaning and significance of the data.

ii. Objectives of Financial Statements Analysis

- To assess the current profitability and operational efficiency of the firm as a whole as well as its different departments so as to judge the financial health of the firm.

- To ascertain the relative importance of the different components of the financial position of the firm

- To identify the reasons for change in the profitability/ financial position of the firm.

- To judge the ability of the firm to repay its debt and assessing the short-term as well as the long-term liquidity position of the firm.

iii. Significance/Importance/Uses of Financial Statements Analysis

- Investors: Shareholders or proprietors of the business are interested in the well-being of the business. They like to know the earning capacity of the business and its prospects of future growth.

- Management: The management is interested in the financial position and performance of the enterprise as a whole and of its various divisions. It helps them in preparing budgets and assessing the performance of various departmental heads.

- Trade Unions: They are interested in financial statements for negotiating the wages or salaries or bonus agreement with the management.

- Lenders: Lenders to the business like debenture holders, suppliers of loans and lease are interested to know short term as well as long term solvency position of the entity.

- Tax Authorities: Tax authorities are interested in financial statements for determining the tax liability.

- Suppliers/Creditors: The suppliers and other creditors are interested to know solvency of the business i.e. the ability of the company to meet the debts as and when they fall due.

- Researchers: They are interested in financial statements for undertaking research work in business affairs and practices.

- Employees: They are interested to know the growth of profit. As a result of which they can demand better remuneration and congenial working environment.

- Government: Government and its regulatory agencies need financial information to regulate the activities of the enterprises/ industries and determine taxation policy. They suggest measures to formulate policies and regulations.

- Stock Exchange: The stock exchange members take interest in financial statements for the purpose of analysis because they provide useful financial information about companies.

iv. Limitations of Financial Statements Analysis

- Limitations of Financial Statements: Financial analysis is based on financial statements, however, financial statements itself suffer from certain limitations, for example, (a) sometimes the information given in financial statements are incomplete and not authentic, (b) financial Statements are based on accounting concepts and conventions. As such, the utility of financial analysis is decreased due to the shortcomings of financial statements.

- Affected by Window Dressing: Some firms resort to window-dressing their financial statements to cover up bad financial position on the eve of accounting date. For example, they may not record the purchases made at the end of the year or they may overvalue their closing stock. In such cases, the results obtained by analysis of financial statements will be misleading.

- Subjectivity: If two firms adopt different accounting policies, the comparison between the two will be unreliable. For example, one firm may provide depreciation on original cost method, whereas the other firm may adopt the written-down value method for providing the depreciation. Similarly, the method of valuation of closing stock may also differ from one firm to another. The results obtained from the comparison of the financial statements of such firms may give misleading picture.

- Difficulty in Forecasting: Financial statements are a record of past events and historical facts. In the fast changing and developing modern business, the analysis of past information may not be of much use in future forecasting. Continuous changes take place in the demand of the product, policies adopted by the firm, the position of competition etc. As such, no estimate based on the analysis of historical facts can be made for future.

- Lack of Qualitative Analysis: Financial statements record only those events and transactions which can be expressed in terms of money. Qualitative aspects of business units are omitted from the books at all as these cannot be expressed in monetary terms. Thus, changes in management, reputation of the business, cordial management-labour relations, firm’s ability to develop new products, efficiency of management, satisfaction of firm’s customers etc. which have a vital bearing on the profitability of the company are all ignored and omitted from being recorded because all of these are qualitative in nature.

Topic – 2 | COMPARATIVE STATEMENTS

Study Material & Notes

Study Material & Notes for the Chapter 11

Financial Statements Analysis & Tools

II. COMPARATIVE STATEMENTS

i. Comparative Statements

- It is the statement prepared to compare individual items or components of the financial statements of two or more years of a company.

- The amount of each component of company’s financial statements is placed side by side and difference is ascertained, which is shown as a percentage of the base year.

- A comparison of components of company’s financial statements of two or more years is known as Intra-Firm comparison, whereas Comparison of company’s financial statements with another Organisation is called inter-firm comparison.

ii. Comparative Balance Sheet

- It is the statement prepared to compare individual items or components of Balance Sheet of two or more years of a company.

iii. Comparative Statement of Profit & Loss

- It is the statement prepared to compare individual items of Statement of Profit & Loss of two or more years of a company.

Topic – 3 | COMMON SIZE STATEMENTS

Study Material & Notes

Study Material & Notes for the Chapter 11

Financial Statements Analysis & Tools

III. COMMON SIZE STATEMENTS

i. Common Size Statements

- Common-size statement means a statement which expresses all items of a financial statement as a percentage of some common base.

- It ascertains the relative importance of different components of the financial statement.

ii. Common Size Balance Sheet

- Common-size balance sheet means a Balance sheet in which figures reported in Balance sheet are converted into percentages to total assets or total of equity and liabilities.

- In the Balance sheet, Total of assets or Total of equity & liabilities is taken as 100 and all other figures are expressed as a percentage of the total assets or total equity & liabilities.

iii. Common Size Statement of Profit & Loss

- Common-size statement of profit and loss means an Income statement in which figures reported in the Statement of profit & loss are converted into percentages to Revenue from Operations.

- In Statement of profit and loss, sales may be assumed to be equal to 100 and all other figures are expressed as a percentage of the Sales/Revenue from Operations.

Topic – 4 | CONTENTS OF THE BALANCE SHEET

Study Material & Notes

Study Material & Notes for the Chapter 10

FINANCIAL STATEMENTS

IV. Contents of the Balance Sheet

| Category | Main Head | Sub-Head | Item |

|---|---|---|---|

| Liability | Shareholders’ Funds | Share Capital | Equity Shares |

| Liability | Shareholders’ Funds | Share Capital | Preference Shares |

| Liability | Shareholders’ Funds | Share Capital | Calls-in-Arrears (Less) |

| Liability | Shareholders’ Funds | Reserves and Surplus | Forfeited Shares |

| Liability | Shareholders’ Funds | Reserves and Surplus | Capital Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Capital Redemption Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Securities Premium Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Debentures redemption Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Revaluation Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Shares Options Outstanding Amount |

| Liability | Shareholders’ Funds | Reserves and Surplus | Other Reserves |

| Liability | Shareholders’ Funds | Reserves and Surplus | Surplus i.e., Balance in Statement of Profit and Loss (Profit/Loss) |

| Liability | Non-Current Liabilities | Long-term Borrowings | Debentures |

| Liability | Non-Current Liabilities | Long-term Borrowings | Bonds |

| Liability | Non-Current Liabilities | Long-term Borrowings | Term Loan from Bank/Others |

| Liability | Non-Current Liabilities | Long-term Borrowings | Public Deposits |

| Liability | Non-Current Liabilities | Long-term Borrowings | Other Loans and Advances |

| Liability | Non-Current Liabilities | Deferred Tax Liabilities (Net) | Deferred Tax Liabilities |

| Liability | Non-Current Liabilities | Deferred Tax Liabilities (Net) | Deferred Tax Assets |

| Liability | Non-Current Liabilities | Other Long-term Liabilities | Premium Payable on Redemption of Preference Shares |

| Liability | Non-Current Liabilities | Long-term Provisions | Premium Payable on Redemption of Debentures |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Employees Retirement Benefits |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Gratuity |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Earned Leaves |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Warranty Claims |

| Liability | Current Liabilities | Short-term Borrowings | Loans repayable on demand |

| Liability | Current Liabilities | Short-term Borrowings | Bank Overdraft |

| Liability | Current Liabilities | Short-term Borrowings | Cash Credit from Banks |

| Liability | Current Liabilities | Short-term Borrowings | Current Maturities of Long-Term Debts |

| Liability | Current Liabilities | Short-term Borrowings | Loans repayable within 12 months |

| Liability | Current Liabilities | Short-term Borrowings | Deposits |

| Liability | Current Liabilities | Short-term Borrowings | Other Loans and Advances |

| Liability | Current Liabilities | Trade Payables | Sundry Creditors |

| Liability | Current Liabilities | Trade Payables | Bills Payable |

| Liability | Current Liabilities | Other Current Liabilities | Interest Accrued but not due on Borrowings |

| Liability | Current Liabilities | Other Current Liabilities | Interest Accrued and due on Borrowings |

| Liability | Current Liabilities | Other Current Liabilities | Income received in advance |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid Dividends |

| Liability | Current Liabilities | Other Current Liabilities | Excess application money refundable and interest thereon |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid matured deposits and interest accrued thereon |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid matured debentures and interest accrued thereon |

| Liability | Current Liabilities | Other Current Liabilities | Calls-in-Advance |

| Liability | Current Liabilities | Other Current Liabilities | Outstanding Expenses |

| Liability | Current Liabilities | Other Current Liabilities | Provident Funds Payable |

| Liability | Current Liabilities | Other Current Liabilities | ESI Payable |

| Liability | Current Liabilities | Other Current Liabilities | Other Payables within Operating Cycle/12 months |

| Liability | Current Liabilities | Short-term Provisions | Provision for Employee Benefits (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Provision for Expenses (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Provision for Tax (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Other Provisions (within Operating Cycle/12 months) |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Property Plant & Equipments |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Intangible Assets |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Capital Work in Progress |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Intangible Assets under Development |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Land |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Building |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Machinery |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Furniture & Fixtures |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Computers |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Vehicles |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Office Equipment |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Goodwill |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Brands |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Trademarks |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Computer Software |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Mining Rights |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Copy Rights |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Patents |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Licenses |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Franchise |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Capital Work in Progress | Tangible Assets under Construction |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets under Development | Patents under Development |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets under Development | Intellectual Property rights under Development |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Property (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Equity Instruments (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Preference Shares (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Government or Trust Securities (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Debentures (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Bonds (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Mutual Funds (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Partnership Firms (to be sold after 12 months) |

| Assets | Non-Current Assets | Deferred Tax Assets (Net) | Deferred Tax Assets (Net) |

| Assets | Non-Current Assets | Long-term Loan and Advances | Capital Advances (for tangible/intangible assets) |

| Assets | Non-Current Assets | Long-term Loan and Advances | Long-term Loans to Employees |

| Assets | Non-Current Assets | Long-term Loan and Advances | Long-term Advances to Vendors |

| Assets | Non-Current Assets | Other Non-current Assets | Security Deposits given (> 12 months/Operating Cycle) |

| Assets | Non-Current Assets | Other Non-current Assets | Long-term Trade Receivables (> 12 months/Operating Cycle) |

| Assets | Non-Current Assets | Other Non-current Assets | Unamortized Expenses/Losses |

| Assets | Non-Current Assets | Other Non-current Assets | Insurance Claims Recoverable |

| Assets | Current Assets | Current Investments | Investments in Equity Instruments (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Preference Shares (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Government or Trust Securities (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Debentures (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Bonds (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Mutual Funds (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Partnership Firms (to be sold within 12 months) |

| Assets | Current Assets | Inventories | Raw Materials |

| Assets | Current Assets | Inventories | Work-in-Progress |

| Assets | Current Assets | Inventories | Finished Goods |

| Assets | Current Assets | Inventories | Stock-in-Trade |

| Assets | Current Assets | Inventories | Goods Purchased for Trading |

| Assets | Current Assets | Inventories | Stores & Spares |

| Assets | Current Assets | Inventories | Loose Tools |

| Assets | Current Assets | Trade Receivables | Debtors |

| Assets | Current Assets | Trade Receivables | Provision for Doubtful Debts |

| Assets | Current Assets | Trade Receivables | Bills Receivables |

| Assets | Current Assets | Cash and Cash Equivalents | Cash in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Credit Balance as per Bank Accounts |

| Assets | Current Assets | Cash and Cash Equivalents | Cheques in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Drafts in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Fixed Deposits with Banks |

| Assets | Current Assets | Short-term Loans and Advances | Loans and Advances realized within 12 months/Operating Cycle |

| Assets | Current Assets | Other Current Assets | Prepaid Expenses |

| Assets | Current Assets | Other Current Assets | Accrued Income |

| Assets | Current Assets | Other Current Assets | Dividend Receivable |

| Assets | Current Assets | Other Current Assets | Advance Taxes |

Topic – 5 | Interest on Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

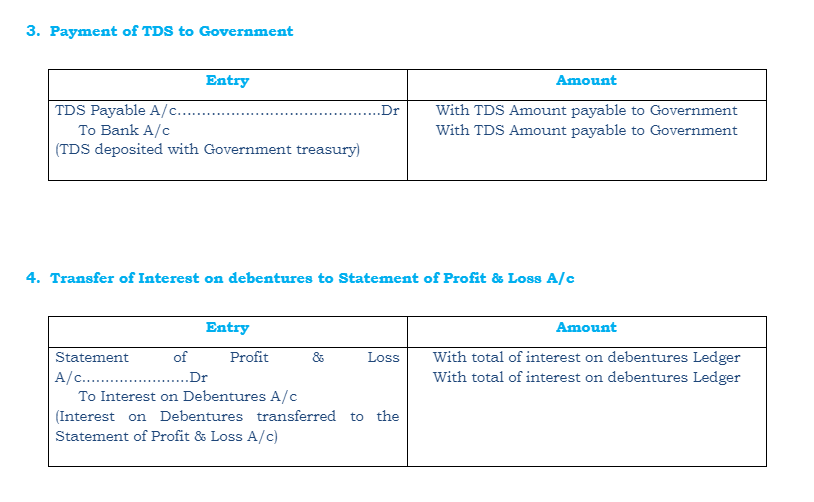

V. INTEREST ON DEBENTURES

- When a company issues debentures, it has to pay interest thereon at fixed percentage periodically (quarterly/half yearly/yearly) until debentures are repaid

- Interest is computed at the nominal value of debentures.

- This percentage is usually as part of the name of debentures like 8% debentures, 10% debentures, etc.

- Interest on debenture is a charge against the profit of the company and must be paid regularly even when Company suffers a loss or does not earn profits.

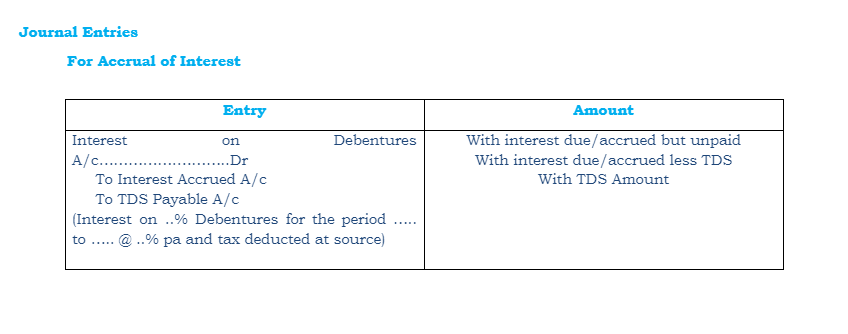

- According to Income Tax Act, 1961, a company paying interest on debentures is required to deduct income tax at the prescribed rate from the gross amount of debenture interest (if it exceeds the prescribed limit) before any payment is made to the debenture holders (Tax Deducted at Source).

Illustration

Debenture Face Value | Rs. 100 |

Number of Debentures | 10,000 |

Period | 6 months |

Interest rate | 9% per annum |

Profit & Loss A/c | Loss Rs. 75,00,000 |

Interest Amount | (10,000×100)x9%x6/12 = Rs. 45,000 |

Income Tax (TDS) @ 10% | 45,000×10% = Rs. 4,500/- |

Interest Net of TDS | 45,000-4,500=Rs. 40,500 |

Interest on Debentures – Accrual

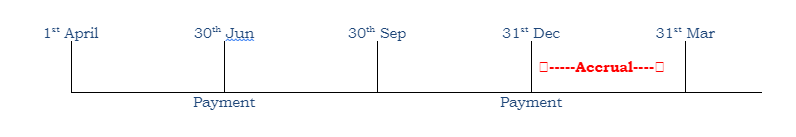

- Interest may be paid periodically and the period may be quarterly, half-yearly or yearly

- The date of payment of interest may be coincide with the end of the accounting period

- For example interest is payable half yearly on 30th Jun and 31st December

- In this case, at the end of the accounting year on 31st March, interest for the period 1st Jan to 31st Mar needs to be accrued in the books of accounts

Topic – 6 | Writing Off Discount/Loss on Issue of Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

VI. WRITING OFF DISCOUNT/LOSS ON ISSUE OF DEBENTURES

- Discount or Loss on issue of debentures is a capital loss and is written-off in the year it is incurred i.e. in the year debentures are allotted.

- Discount or loss is written-off from the following:

- From Capital Reserve

- From Securities Premium Reserve [section 52(2)]

- From General Reserve

- Against revenue profits of the year