Class 12th Chapters

- 8. Company – Accounting for Share Capital

- 9. Company – Issue of Debentures

Company – Accounting for Share Capital

Topic – 1 | Meaning, Features & Type of Companies:

Study Material & Notes

Study Material & Notes for the Chapter 8

COMPANY – ACCOUNTING FOR SHARE CAPITAL

Meaning, Features & Type of Companies

I. ISSUE OF SHARE CAPITAL – MEANING, FEATURES AND TYPE OF COMPANIES

A. Company – Definition & Meaning

Definition

- According to Section 2(20) of the Companies Act, 2013, “Company means a company incorporated under this act or any previous Company law.”

Meaning

- A company is an association of persons formed and registered under the Companies Act.

- It is a legal person not having a physical existence.

- It has a separate legal entity which is separate from its members and having share capital into units called shares

- The shareholders contribute towards the capital by buying its shares.

- Shareholders are called owners of a company.

B. Characteristics of a Company

Artificial Legal Person:– A company is an artificial person as it is created by law. It has almost all the rights and powers of a natural person. It can enter into contract. It can sue in its own name and can be sued.

Incorporated Body:– A company must be registered under Companies Act. By virtue of this, it is vested with corporate personality. It has an identity of its own.

Capital Divisible into Shares:– The capital of the company is divided into shares. A share is an indivisible unit of capital. The face value of a share is generally of a small denomination like Rs.5, Rs.10, Rs. 100

Transferability of Shares:– The shares of the company are easily transferable. The shares can be bought and sold in the stock market

Perpetual Existence:– A company has an independent and separate existence distinct from its shareholders. Changes in its membership due to death, insolvency etc. does not affect its existence and its continuity.

Limited Liability:– The liability of the shareholders of a company is limited to the extent of face value of shares held by them. No shareholder can be called upon to pay more than the face value of the shares held by them. At the time of winding up, if necessary, the shareholders may be asked to pay the unpaid value of shares

Representative Management:– The number of shareholders is so large and scattered that they cannot manage the affairs of the company collectively. Therefore they elect some persons among themselves to manage and administer the company. These elected representatives of shareholders are individually called the ‘directors’ of the company and collectively the Board of Directors.

Common Seal:– A common seal is the official signature of the company. Any document bearing the common seal of the company is legally binding on the company.

C. Types of Company – On the basis of Ownership:

Private Company

- restricts the right to transfer its shares, if any.

- except in the case of One Person Company, limits the number of its members excluding its present and past employee members to 200; if the past or present employee acquired the shares while in employment and continue to hold them. If any share is held jointly by two or more persons, they shall be treated as a single member.

- prohibits any invitation to the public to subscribe for any securities of the company. The minimum number of members required to form a private company is two.

The name of a Private Company ends with the words, ‘Private Limited’.

Public Company

- is not a one person company or a private company;

- is a private company, being a subsidiary of a company which is not a private company.

Minimum number of members required to form a public limited company is seven. There is no restriction on maximum number of members.

The name of a public company ends with the word ‘Limited’.

One Person Company

Section 2 (62) of the companies Act, 2013, defines One Person Company as a “company which has only one person as a member”. Rule 3 of the Companies (Incorporation) Rules, 2014 provides that:

- Only a natural person being an Indian citizen and resident in India can form one person company,

- It cannot carry out non-banking financial investment activities.

- Its paid up share capital is not more than Rs. 50 Lakhs

- Its average annual turnover of three years does not exceed Rs. 2 Crores

Distinction between Private & Public Company

Basis | Private Company | Public Company |

Minimum no. of Members | 2 (Two) | 7 (Seven) |

Maximum no. of Members | 200 (Two Hundred) excluding its present or past employee members | No Limit |

Minimum no. of Directors | 2 (Two) | 3 (Three) |

Maximum no. of Directors | 15 (Fifteen) | 15 (Fifteen) |

Name | ‘Private Limited’ is used at the end of the company’s name | ‘Limited’ is used at the end of the company’s name |

Invitation to Public | It cannot invite public to subscribe to its shares | It invites public to subscribe to its shares. |

Transfer of Shares | Articles of Association of the company restrict transfer of shares | Listed Companies–allowed without restriction, Unlisted Companies–restricted by the Articles of Association |

Prospectus | Prospectus is not issued | Prospectus must be issued to invite public to subscribe for shares, if not a Statement in Lieu of Prospectus is filed with Registrar of Companies |

Articles of Association | Special Articles of Association are necessary | Can adopt Table F given in the Companies Act, 2013 or can have its own having different clauses |

Allotment of Shares | Shares may be allotted as the Directors decide. | Listed Companies–Shares can be allotted only if minimum subscription has been received. Unlisted Companies–Shares may be allotted as the Directors decide. |

Topic – 2 | Types and Classification of Shares & Share Capital:

Study Material & Notes

Study Material & Notes for the Chapter 8

COMPANY – ACCOUNTING FOR SHARE CAPITAL

II. ISSUE OF SHARE CAPITAL – TYPES & CLASSIFICATION OF SHARES & SHARE CAPITAL

A. Definition & Meaning of Shares

Definition of Share

- According to Section 2(84) of the Companies Act, 2013 ‘Share’ means a share in the share capital of a company and includes stock.

Meaning of Share

- A company divides its capital into units of equal denomination. Each unit is called a share.

- Each share has a nominal value of face value e.g. 10,100.

- For example, total capital of the company is Rs. 8,00,00,000 divided into 80,00,000 units of Rs. 10 each. Each unit of Rs. 10 will be called a share.

- These shares are offered to Public for sale to raise capital. This is termed as issuing shares.

- A person who buys share/shares of the company is called a shareholder and by acquiring share or shares in the company he/she becomes one of the members of the company and forms the basis of ownership interest in a company.

B. Meaning & Type of Share Capital

Meaning of Share Capital

- Share capital of a company refers to the amount of capital that a company can raise or has raised by issue of shares

- Share Capital is equal to the Number of shares multiplied by Nominal value of shares.

- The amount invested by the shareholders towards the face value of shares is called share capital

- The amount of share capital desired to be registered by the company is stated in its Memorandum of Association

Type of Share

- According to Section 43 of the Companies Act, 2013, a company can issue two types of shares (a) Preference Share & (b) Equity Share

a) Preference Shares Section 43(b)

Preference shares are the shares that carry the following two rights:

- Preferential right of dividend is to be paid as fixed amount or an amount calculated at a fixed rate.

- On winding up or repayment of capital, a preferential right to be repaid the amount of capital before any amount is paid to the equity shareholders.

b) Equity Shares Section 43(1)

Equity shares are the shares which are not preference shares.

- Thus, this share does not carry any preferential right, equity share is one which is entitled to dividend and repayment of capital on winding-up of the company after the claim of preference shares is satisfied.

- Equity shareholders have the right to elect directors of the company. Equity shares are the permanent source of capital.

Distinction between Equity Shares & Preference Shares

Basis | Equity Shares | Preference Shares |

Rate of Dividend | Rate of dividend on Equity shares is variable and depends upon the decision of the Board of directors | Rate of dividend on Preference shares is fixed. |

Payment of Dividend | Dividend on Equity shares is paid after payment of dividend to preference shareholders | Dividend on Preference shares is paid before payment of dividend to equity shareholders |

Refund of Share Capital on Winding up of the Company | On winding up of the company equity share holders get refund of capital only after preference share holders have been paid off. | Preference shareholders have a preference over equity shareholders in regard to refund of capital in case of winding up of the company |

Voting Rights | Equity Shareholders have voting rights in all matters | Preference Shareholders can vote only in special circumstances |

Redemption | Equity Shares cannot be redeemed during the life of the company. | Preference Shares can be redeemed as per terms of issue. |

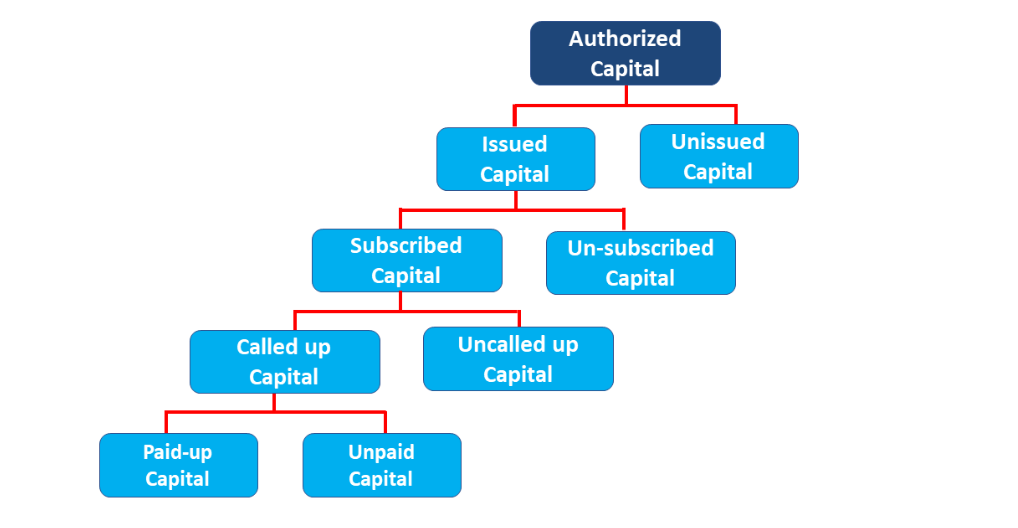

C. Types of Share Capital

a) Authorized Capital:-

According to Section 2(8) of Companies Act, 2013, authorised capital means such capital as is authorised by the Memorandum of a Company to be the maximum amount of share capital of a company. It is also known as Nominal or Registered Capital

Issued Capital:-

- According to Section 2(50) of the Companies Act, 2013, issued capital means such capital as the company issues from time-to-time for subscription.

- A company may issue its entire authorised capital or may issue it in parts from time to time as per the needs of the company.

- It means and includes the nominal value of shares issued by the company for (a) cash, and (b) consideration other than cash to (i) promoters of a company, and (ii) others like vendors or signatories to the company’s memorandum.

Unissued Capital:-

The remaining portion not yet offered to the public for subscription is called the unissued capital which can be issued later on.

b) Authorized Capital:-

Subscribed Capital:-

- According to Section 2(86) of the Companies Act, 2013, subscribed capital means such part of the capital which is for the time being subscribed by the members of a company.

- The portion of nominal value of the issued share capital which is actually paid (or subscribed) by the shareholders forms part of the subscribed capital

Unsubscribed Capital:-

- The balance of issued capital not subscribed for by the public is called the unsubscribed capital.

c) Subscribed Capital:-

Called up Capital:-

- According to Section 2(15) of the Companies Act, 2013, called up capital means such part of the capital which has been called for payment

- The portion of the issue price of the shares which a company has demanded or called from shareholders is known as called up capital.

Uncalled Capital:-

- Uncalled Capital is that portion of the issued/subscribed capital that is not called up by the company on the shares allotted.

- If the management shows no intention of calling the outstanding money on such shares, then the uncalled capital will be called reserve capital.

- Reserve Capital is that portion of the uncalled capital which a company has decided to call only in case of liquidation of the company.

d) Called up Capital:-

Paid up Capital:-

- According to Section 2(64) of the Companies Act, 2013, ‘Paid-up Share Capital’ means aggregate of money credited and paid-up as is equivalent to the amount received as paid-up in respect of shares issued and also includes any amount credited as paid-up in respect of shares of a company, but does not include any other amount received in respect of such shares, by whatever name called.

Unpaid Capital:-

- It is that part of the called up capital which has been called but has not been paid by the shareholders i.e. calls-in-arrears

e) Subscribed Capital:-

Subscribed & Fully Paid up Capital:-

- When the entire face value of a share is called by the company and is also paid by the shareholder, it is said to be subscribed and fully paid up capital.

Subscribed but & not Fully Paid up Capital:-

- Share capital is said to be subscribed but not fully paid up under following circumstances:

- When the company has not called up the full face value of the share.

- When the company has called up the full face value of the share but the shareholder has not paid some part of the face value of share, i.e., calls-in arrears.

D. Distinction between Reserve Capital and Capital Reserve

Basis | Capital Reserve | Reserve Capital |

Meaning | Capital Reserve means the part of profit reserved by the company for a particular purpose such as to finance long-term projects or to write off capital expenses | It is that portion of the uncalled capital which a company has reserved and decided to call only in case of liquidation of the company to settle its creditors |

Created out of | Capital Profits | Authorized Capital |

Disclosure | On the equity & liabilities side of the balance sheet under the head Reserve and Surplus. | Not disclosed at all |

Specific Condition | No such conditions | Special Resolution should be passed at AGM for its creation |

Utilization | To write of fictitious assets or capital losses etc. | Only when the company is about to wind up. |

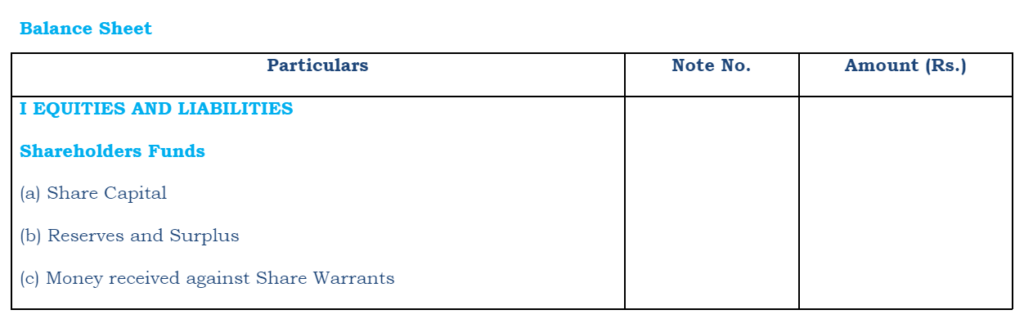

E. Disclosure in the Balance Sheet and Notes to the Accounts

Topic – 3 | Issue of Shares for Cash at Par & Premium:

Study Material & Notes

Study Material & Notes for the Chapter 8

COMPANY – ACCOUNTING FOR SHARE CAPITAL

III. ISSUE OF SHARE FOR CASH AT PAR AND PREMIUM

1. Accounting treatment of Shares Issued for Cash

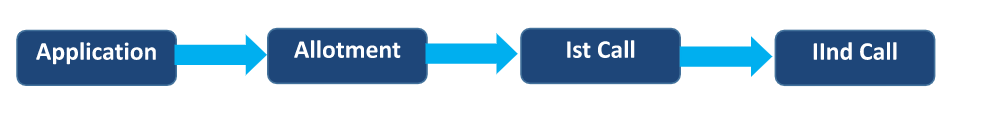

In general, shares are issued for cash. The company may call the share money either in one instalment or in two or more instalments. But company always collects this money through its bankers.

A. Receipt of Share Money in One Instalment

The company may receive the share money in one instalment along with application. In this case the following journal entries are made in the books of the company

B. Receipt of Share Money in Two or More Instalments

- Instead of receiving payment in one instalment i.e. at the time of application the company collects it in two or more instalments.

- The first, instalment which the applicants have to pay along with the applications for shares is known as Application Money.

- On the allotment of shares the allottees are required to pay the second instalment which is termed as Allotment Money.

- If the company decides to call the share money in more than two instalments the other instalment is/are termed as Call Money (i.e. first-call, second call or final call).

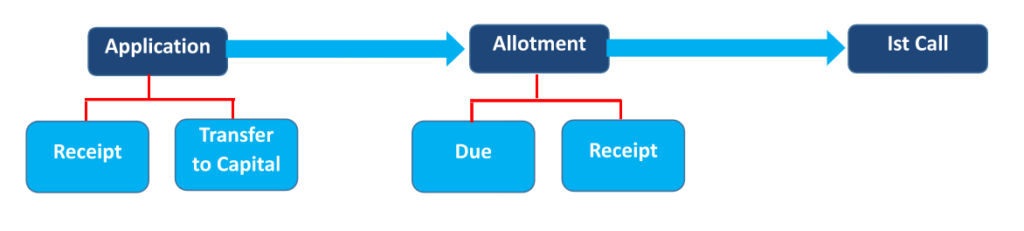

a) Receipt of Share Application Money

b) Allotment Money becoming due:

On the allotment of shares the amount receivable on the next instalment i.e. on allotment becomes due.

c) Call on Shares

- After the receipt of application and allotment money the money that remains unpaid can be called up by the company as and when required

- Thus a call is a demand made by the company asking the shareholders to remit the called up amount on shares allotted to them.

- The company may demand the remaining money in more than two instalments. The amount called after the allotment is known as call money. There may be one or more calls, depending on the fund requirements of the company.

If the company makes more than one call the same accounting treatment is followed for recording the second call or third call money due and their receipt. The last call made is termed as final call.

2. Issue of Shares at Par or Premium

a) Par Value

- Par value means the nominal amount or face value of share

- When issue price of the share is exactly equal to their nominal value or face value shares are said to be issued at par

- For example, share of face value of Rs. 10/- issued at Rs. 10/-

b) Premium

- When the shares of a company are issued at more than its nominal value (face value), the excess amount is called premium

- The premium amount is credited to a separate account called ‘Securities Premium Account’ and is shown under

the title ‘Equity and Liabilities’ of the company’s balance sheet under the head ‘Reserves and Surpluses’ - For example, share of face value of Rs. 10/- issued at Rs. 12/- then it is said to be issued at premium of Rs. 2/-

c) Securities Premium Reserve

As per Section 52(1) of the Companies Act, 2013, where company issues shares at a premium, whether for cash

or otherwise, a sum equal to aggregate amount of premium received in those shares shall be transferred to separate account called Securities Premium Account.

As per Section 52(2) of the Companies Act, 2013 Securities Premium Amount may be applied or utilized for the following purposes

- To write off preliminary expenses of the company

- To write off the commission paid or discount/expenses on issue of shares/debentures.

- To issue fully paid-up bonus shares to the existing shareholders.

- To provide premium on the redemption of preference shares or debentures of the company.

- To buy back of its own shares as per Section 68: The term buy back of shares implies the act of purchasing its own shares from stock market by a company either from free reserves, securities premium reserve or proceeds of any shares or debentures.

Topic – 4 | Oversubscription & Undersubscription of shares:

Study Material & Notes

Study Material & Notes for the Chapter 8

COMPANY – ACCOUNTING FOR SHARE CAPITAL

IV. OVERSUBSCRIPTION AND UNDERSUBSCRIPTION OF SHARES

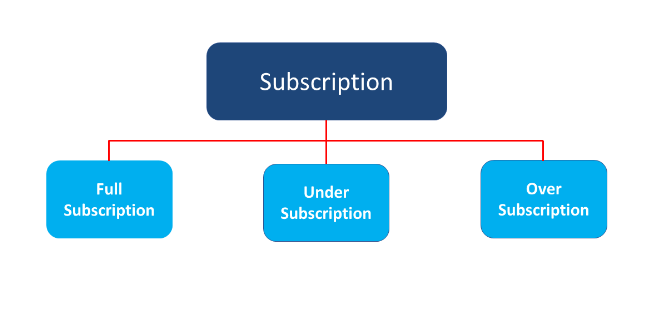

A. Full Subscription of Shares

Meaning

Full-subscription is a situation where number of shares applied for is equal to the number for which applications have been invited for subscription.

Example

A company has offered 1,00,000 shares to the public and the public has applied for all the 1,00,000 shares, it is said to be full subscription.

Accounting treatment

As number of applications received is equal to the number of shares offered, accounting entries towards receipt of application money, allotment of shares will be passed on the basis of shares offered by the company.

B. Under Subscription of Shares

Meaning

Under subscription is a situation where number of shares applied for is less than the number for which applications have been invited for subscription..

Example

A company offered 2,00,000 shares for subscription to the public but the applications were received for 1,90,000 shares only.

Accounting treatment

- In such a situation, the allotment will be confirmed to 1,90,000 shares and entries shall be made accordingly. It must be ensured that the company has received the minimum subscriptions, if not the company will have to refund the entire subscription amount received

- As per SEBI (ICDR) regulations, if the amount of minimum subscription is not received to the extent of 90%, the issue dissolves.

C. Over Subscription of Shares

Meaning

Over-subscription is a situation where number of shares applied for is more than the number for which applications have been invited for subscription.

Example

A company offered 1,00,000 shares for subscription to the public but the applications were received for 2,00,000 shares

Accounting treatment

In such a condition, three alternatives are available to the directors to deal with the situation:

- they can accept some applications in full and totally reject the others;

- they can make a pro-rata allotment to all;

- they can adopt a combination of the above two alternatives which happens to be the most common course adopted in practice.

Distinction between Over Subscription of Shares

Basis | Over Subscription | Under Subscription |

Meaning | Number of shares applied by the public is more than the shared offered for subscription | Number of share applied by the public is less than the shared offered for subscription |

Limit | No limit | 90%. If the shares applied is less than 90%, the issue is dissolved |

Allotment of Shares | Complete rejection, Pro-rata, rejection or both | All the applicants get the shares |

Excess money | Can be refunded or adjusted with allotment money or calls | There is no excess money |

Topic – 5 | Calls In Arrears & Calls in Advance:

Study Material & Notes

Study Material & Notes for the Chapter 8

COMPANY – ACCOUNTING FOR SHARE CAPITAL

V. CALLS IN ARREARS AND CALLS IN ADVANCE

A. Calls in Arrears

Meaning

Sometimes, the full amount called on allotment and/or call (calls) is not received from the allottees/shareholders.

When any shareholder fails to pay the amount due on allotment or on any of the calls, such amount is known as ‘Calls in Arrears’/‘Unpaid Calls’.

Accounting treatment

There are two ways to treat Calls-in-Arrears.

Method-1

Amount not received towards allotment or calls is debited to a newly opened account ‘Calls-in-Arrear Account’.

Subsequently, when the arrear/unpaid amount is received, Bank A/c is debited and the Calls-in-Arrear A/c is credited.

Method-2

Under this method, Calls-in-Arrears A/c is not opened.

Whatever amount is received from the shareholder is credited to the call account. The call account will show a debit balance equal to the unpaid amount of the call.

Subsequently, when the arear/unpaid amount is received, Bank A/c is debited and the relevant call A/c is credited.

Interest

Interest can be charged on unpaid calls for the period intervening between due date of the call and the time of actual payment at the rate specified in The Articles of Association of the company

If the Articles of Association is silent, interest can be charged @ 10% p.a. as per Table F of Schedule I of the Companies Act, 2013

The Directors of the Company have the right to waive this interest payment either wholly or partially

Disclosure in the Balance Sheet

Calls in Arrears is an Assets and is clubbed under the sub-head ‘Shareholder Funds’ and disclosed as below

- Share Capital:

Shareholders Funds

Disclosure in the Notes to the Accounts

- Shareholders Funds:

Subscribed Capital

Subscribed but not Fully Paid up

…… Equity/Preference Shares of Rs. .…. each, Rs. ..… called up

Less: Call in Arrears

B. Calls in Advance

Meaning

- Sometimes shareholders pay a part or the whole of the amount of the calls not yet called-up by the Company on the shares allotted to them.

- Such amount paid by a shareholder in the excess of the amount due from him on allotment/calls is known as ‘Calls in Advance’

Accounting treatment

- Amount received towards call in advance is credited to a separate account ‘Call in Advance Account.”

- The amount received towards Call in Advance is adjusted subsequently towards the payment of calls as and when they becomes due.

- The amount of particular calls in advance is deducted from the particular calls by debiting the Calls in Advance A/c

Interest

- Interest shall be paid on calls money received in advance for the period intervening between due date of the call and the time of actual payment at the rate specified in The Articles of Association of the company

- If the Articles of Association is silent, interest can be paid @ 12% p.a. maximum as per Table F of Schedule I of the Companies Act, 2013

Disclosure in the Balance Sheet

Calls in Advance is a liability of the Company, it is clubbed under the sub-head ‘Other Current Liabilities’ and disclosed in the Balance Sheet in the following manner

4. Current Liabilities:

(C)Other Current Liabilities

Distinction between Calls in Arrears and Calls in Advance

Topic – 6 | Shares Issued for Consideration Other than Cash, Private Placement & ESOP:

Study Material & Notes

Study Material & Notes for the Chapter 8

Partnership – ACCOUNTING FOR SHARE CAPITAL

VI. SHARES ISSUED FOR CONSIDERATION OTHER THAN CASH, PRIVATE PLACEMENT AND EMPLOYEES STOCK OPTION PLAN (ESOP)

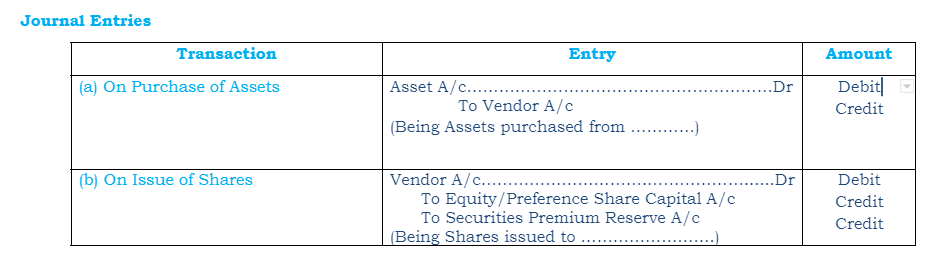

A. Accounting Treatment of Shares Issued for Consideration Other than Cash

1) On Purchase of Assets

- Where a company has purchased assets from a vendor and enters into an arrangement with the said vendor that instead of settlement of his dues in cash, the vendor agrees to accept fully paid shares of the company issued to them.

- These shares can be issued at par or at premium, and the number of shares to be issued will depend upon the price at which the shares are issued and the amount payable to the vendor

- The number of shares issued to the vendor will be calculated as = Amount Payable/ Issue Price

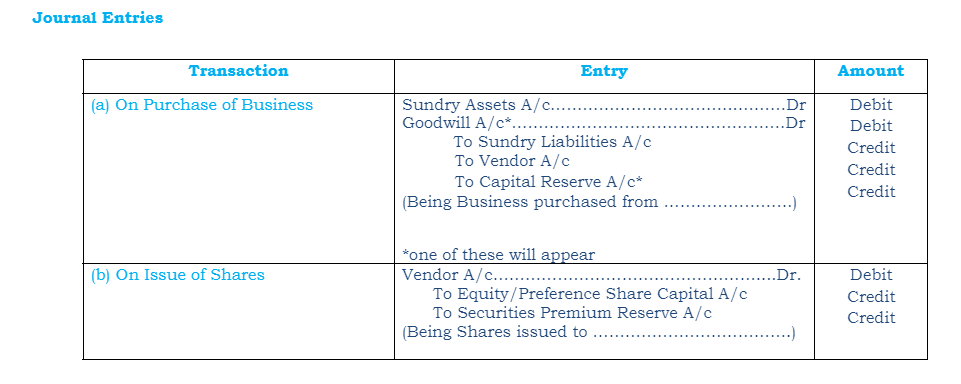

2) On Purchase of Business

- Where a company purchases business of another entity and enters into an arrangement with the said entity that instead of settlement of their dues in cash, the owners of the entity agrees to accept fully paid shares of the company issued to them.

- These shares can be issued at par or at premium, and the number of shares to be issued will be calculated as Purchase Consideration Amount/Issue price

3) Issue of Shares to Promoters

- Sometimes shares are issued to the promotors of the company in lieu of the services provided by them during the incorporation of the company.

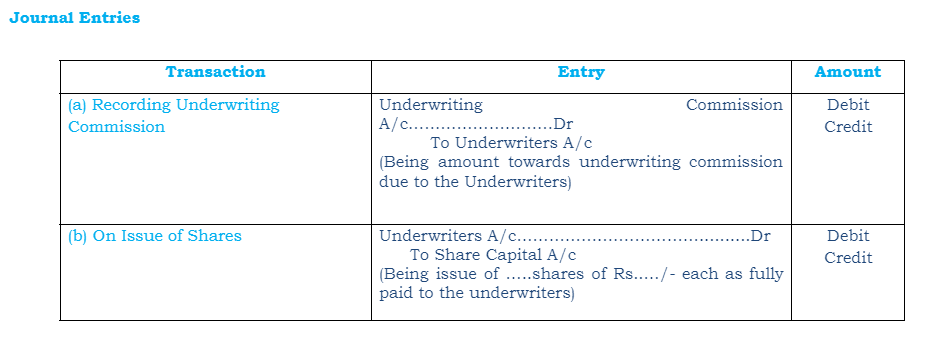

4) Issue of Shares to Underwriters

- The Company enters a contract with a person know an Underwriter who takes the shares in his own name which are not subscribed by the public. The Underwriter charges a commission for his servicers.

Important:-

Issue of shares for consideration other than cash are disclosed separately under disclosure of “Share Capital” in the notes to the accounts as subscribed and fully paid-up capital

B. Private Placement of Shares

Definition & Meaning

Private Placement as per Section 42 means:

- any offer or invitation to subscribe or issue of securities

- to a select group of persons by a company (other than by way of public offer)

- through private placement offer-cum-application, which satisfies the conditions specified in this section.

Features

There are three features which distinguish the private placement from other issues.

- Securities to be issued to the selected group of person

- It should not be a public issue.

- Issued as per the provision of this section i.e. Section 42.

Offer/ Invitation to subscribe for shares

- Maximum 50 persons in one go

- 200 persons in aggregate in one financial year

- These limits are individually applicable for each kind of securities

Minimum Investment value

- Investment size of not less than INR 20,000/- of face value of securities per person

C. Employees Stock Option Plan

Meaning

- Employee stock option plan (ESOP) or Equity incentive plan is the scheme used by the companies to give ownership interest to its employees. ESOP is regulated by Section 62(1) (b) of the Companies Act, 2013

- An ESOP is an option given to its whole time directors and permanent employees the benefit or the right to purchase the stock of the company at a predetermined price which is generally at lower than market price. The participation in this scheme by the employees is purely voluntary.

- Shares allotted under this scheme are locked for a minimum period of one year from the allotment date

Procedure followed for the formulation of ESOPs

- A Compensation committee is formulated by the Board of Directors and consist of a majority of independent directors

- The Compensation Committee drafts a plan in accordance with the guidelines provided by the SEBI

- The Compensation Committee presents the ESOP to the Board of Directors and seeks their approval

- The plan is approved by majority shareholders (3/4th of the total shareholders) through a special resolution.

- Management / Compensation committee decides on list of employees to whom ESOPs are to be granted & places it before Board for approval through ordinary resolution. This is again ratified by Shareholders at meeting held at future dates.

After approval from Board of Directors, Management issues letter of acceptance to employees. After receipt of letter of acceptance of option, employees are eligible to exercise options once these are vested as per ESOP plan.

The Company holds a Board Meeting at regular intervals during the exercise period for allotment of shares on options exercised by the employees.

Topic – 7 | Forfeiture of Shares:

Study Material & Notes

Study Material & Notes for the Chapter 8

Partnership – ACCOUNTING FOR SHARE CAPITAL

VII FORFEITURE OF SHARES

1) Meaning of Forfeiture of Shares

- The issue price of shares is payable in instalments i.e. on application, on allotment and on calls made from time to time by the Board of Directors of the Company.

- Sometimes some shareholders fail to pay the called-up amount in full i.e., they do not pay one or more instalments after the allotment of the shares to them.

- In such a case either the company can go to the court and file a suit against the defaulting shareholders for recovery of the due amount or can cancel the membership of the defaulting shareholders.

- In case the membership is cancelled, the amount paid by the defaulting members towards share capital stands forfeited. It is called ‘Forfeiture of Shares.’

- With the cancellation, the defaulting shareholder also loses the amount paid by him/her on such shares.

2) Effect and Results of the Forfeiture

- Cancellation of membership of the defaulting shareholder.

- Reduction of issued Share Capital of the company.

- Company forfeits amount paid by Defaulting shareholder on such shares.

- Defaulting shareholder loses amount paid by him/her on such shares.

3) Accounting Treatment – Shares Issued at Par

4) Accounting Treatment – Shares Issued at Premium

Case -1 Premium on shares has been received prior to the forfeiture

- Amount of Share premium once received, stays in the Securities Premium A/c and cannot be reversed or credited to any other account. Section 52 of the Companies Act, 2013 restricts usage of share premium for certain specific purposes only

- In this case the journal entry of forfeiture of shares will be similar to the entry made as if the shares had been issued at par.

Case -2 Premium on shares has not been received prior to the forfeiture

- In this case, amount of Share Premium is due but money against these are not yet received.

- As the amount towards Share Premium will not be received, we will have to reverse the Securities Premium Reserve A/c as well as the Amount due

Topic – 8 | Reissue of Forfeited Shares:

Study Material & Notes

Study Material & Notes for the Chapter 8

Partnership – ACCOUNTING FOR SHARE CAPITAL

VIII REISSUE OF FORFEITED SHARES

1) Meaning of Reissue of Forfeited Shares

- When shares are forfeited the membership of the shareholder stands cancelled and the shares become the property of the Company.

- The Company has an option of selling such forfeited shares. The sale of forfeited shares is called ‘Reissue of Shares’.

- Though the amount of such shares may be called in more than one instalment but usually the entire amount is called in one instalment i.e. lumpsum.

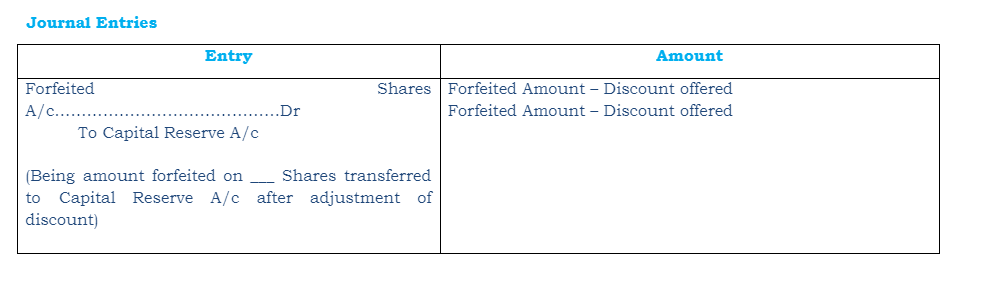

- These shares can be reissued at par, at premium or at discount. Generally, these shares are reissued at a discount at price less than its nominal value.

- Maximum permissible discount for Reissue of shares is equal to the amount forfeited on such shares.

- In case, this amount of discount offered is less than the amount forfeited, the remaining forfeited amount is a capital gain to the company and is transferred to Capital Reserve account.

2) Accounting Treatment

a) Shares Reissued at Par

b) Shares Reissued at Premium

c) Shares Reissued at Discount

3) Reissue of all the Forfeited Shares

- The amount of discount allowed on reissue of shares at the most can be equal to the forfeited amount on such shares.

- If the Company has given discount equal to the amount forfeited,the Forfeited Shares account after reissue will show a zero balance.

- But in case, this amount of discount is less than the amount forfeited, the remaining forfeited amount will be profit for the company.

- This profit is a capital gain to the company and is transferred to Capital Reserve account.

4) Reissue of Part of the Forfeited Shares

- If all the forfeited shares are reissued, the Forfeited Shares A/c will show a zero balance because whole of the amount in this account after adjusting the amount of discount allowed on reissue will be transferred to Capital Reserve account

- But in case, only a part of the forfeited shares are reissued and others remain cancelled, the amount forfeited on forfeited shares not reissued will remain in the Forfeited Shares Account

- Proportionate amount forfeited on share reissued will be calculated in the following manner:

Topic – 9 | Forfeiture of Shares under Pro-rata Category:

Study Material & Notes

Study Material & Notes for the Chapter 8

Partnership – ACCOUNTING FOR SHARE CAPITAL

IX FORFEITURE OF SHARES UNDER PRO-RATA CATEGORY

1) Over Subscription of Shares

Meaning

Over-subscription is a situation where number of shares applied for is more than the number for which applications have been invited for subscription.

Example

A company offered 1,00,000 shares for subscription to the public but the applications were received for 2,00,000 shares

Accounting Treatment

In such a condition, three alternatives are available to the directors to deal with the situation:

- they can accept some applications in full and totally reject the others;

- they can make a pro-rata allotment to all;

- they can adopt a combination of the above two alternatives which happens to be the most common course adopted in practice.

2) Pro-rata Allotment

Case-1 When the directors opt to make a proportionate allotment to all applicants

- In this case, the excess application money received is normally adjusted towards the amount due on allotment.

- If the excess application money received is more than the amount due on allotment of shares, such excess amount may either be refunded or credited to subsequent installments i.e. Calls money.

- For example, in the event of applications for 20,000 shares being invited and those received are for 25,000 shares, it is decided to allot shares in the ratio of 4:5 to all applicants (four shares are allotted for every five shares applied).

- It is a case of pro-rata allotment and the excess application money received on 5,000 shares would be adjusted towards the amount due on the allotment of 20,000 shares.

Case-2 When the application for some shares are rejected outrightly and pro-rata allotment is made to the remaining applicants

- In this case, the money on rejected applications is refunded and the excess application money received from applicants to whom pro-rata allotment has been made is adjusted towards the amount due on the allotment of shares allotted.

- If the excess application money received is more than the amount due on allotment of shares, such excess amount may either be refunded or credited to subsequent installments i.e. Calls money.

- For example, a company invited applications for 10,000 shares and received applications for 15,000 shares. The directors decided to reject the applications for 2,500 shares outright and to make a pro-rata allotment of 10,000 shares to the applicants for the remaining 12,500 shares so that four shares are allotted for every five shares applied.

- In this case, the money on applications for 2,500 shares rejected would be refunded fully and that on the remaining 2,500 shares (12,500 shares – 10,000 shares) would be adjusted against the allotment amount due on 10,000 shares allotted and credited to Share Allotment account

3) Applied vs Allotted

- Remember Shares Applied > Shares Allotted

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Company – Issue of Debentures

Topic – 1 | Meaning, Features, Type and Issue of Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

I. MEANING, FEATURES, TYPES AND ISSUE OF DEBENTURES

A. Definition

According to Section 2(20) of the Companies Act, 2013, “Debenture includes debenture stock, bonds or any other instrument of a company evidencing a debt, whether constituting a charge on the assets of the company or not”

a) Meaning

Debenture is a written instrument acknowledging a debt under the common seal of the company. It contains a contract for repayment of principal after a specified period or at intervals or at the option of the company and for payment of interest at a fixed rate payable usually either half-yearly or yearly on fixed dates.

b) Bond

Bond is also an instrument of acknowledgement of debt. In the Bond instead of rate of interest amount payable on maturity is mentioned.

c) Any other Instrument evidencing a debt

It means any instrument other than debenture or bond issued by the Company substantiating borrowing. For example Company invites money from Pubic in the form of Pubic deposits

d) Charge

- According to Section 2(16) of the Companies Act, 2013, Charge is an interest or lien created on the assets or property of a Company or any of its undertaking as security and includes a mortgage

- Charge on assets means the right of the lender to be paid from a borrower’s asset if the debt is not paid on time.

e) Debenture holders

The persons to whom the debentures are issued, are called debenture holders. The debenture holders are not the owners of the company. They are the lenders of the company.

f) Trust Deed

- The Company issuing debentures to public is required to appoint trustees and execute a trust deed.

- The Trustees protect the interest of the debenture holders through the powers granted by the trust deed.

B. Characteristics/Features of Debentures

- A debenture is a written document or certificate which acknowledges the debt by the company.

- The debenture certificate is issued under the common seal of the company.

- Mode and period of payment of principal and interest is fixed and is stated in the debenture.

- Rate of interest is fixed and is stated in the debenture.

- The debt taken by issue of debentures is usually secured by a charge on the assets of the company.

- It is considered as an external equity or Long-term Borrowings of the company.

C. Distinction between Share and Debenture

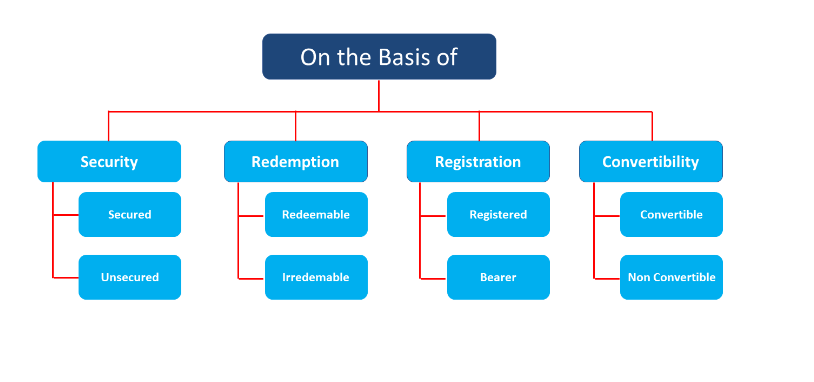

D. Type of Debentures

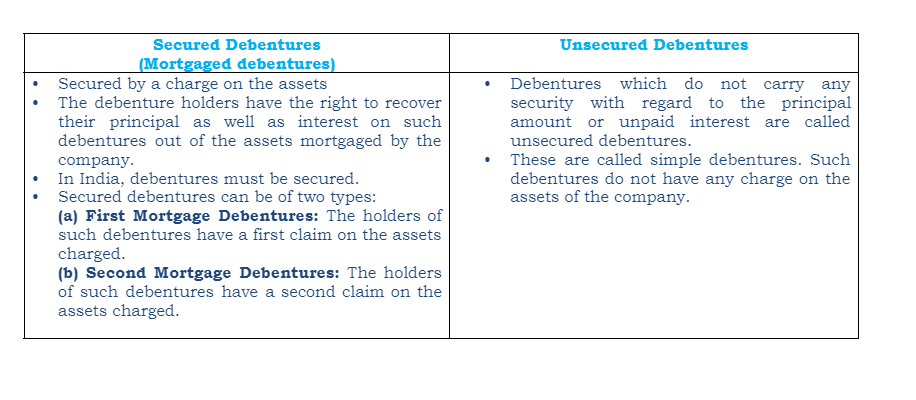

a) On the basis of Security

b) On the basis of Redemption

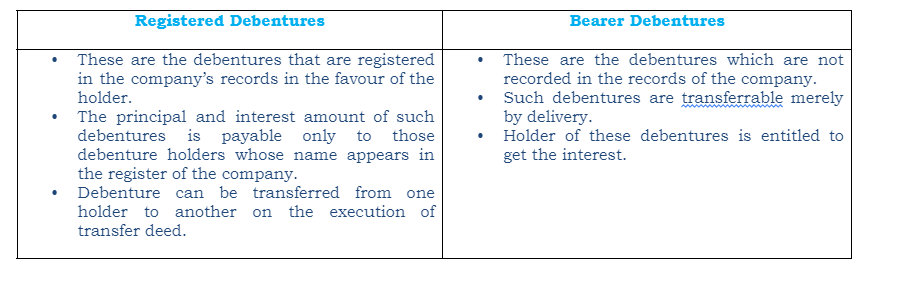

c) On the basis of Registration

d) On the basis of Convertibility

E. Disclosure in the Balance Sheet

Case-A Debentures are due for redemption after 12 months/operating cycle from the Balance Sheet date

Case-B Debentures are due for redemption within 12 months/operating cycle from the Balance Sheet date

F. Issue of Shares at Par, Premium or Discount

a) Par value

- Par value means the nominal amount or face value of debenture

- When issue price of the debenture is exactly equal to their nominal value or face value, Debentures are said to be issued at par

- For example, debenture of face value of Rs. 100/- issued at Rs. 100/-

b) Premium

- When the debentures of a company are issued at more than its nominal value (face value), the excess amount is called premium

- The premium amount is credited to a separate account called ‘Securities Premium Account’ and is shown under the title ‘Equity and Liabilities’ of the company’s Balance Sheet under the head ‘Reserves and Surpluses’

- For example, debenture of face value of Rs. 100/- issued at Rs. 120/- then it is said to be issued at premium of Rs. 20/-

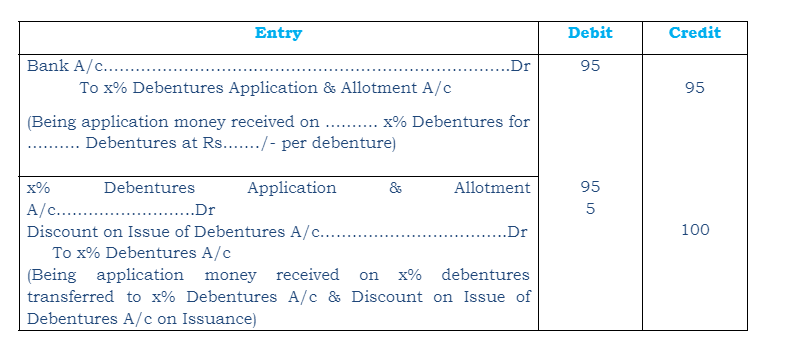

c) Discount

- When debentures are issued at less than their nominal value they are said to be issued at discount

- For example, debenture of Rs. 100 each is issued at Rs. 90 per debenture

- The discount is debited to a separate account called Discount on Issue of Debentures Account.

- Discount on Issue of Debentures is written off in the same year in which debentures were allotted.

- The write off is done from Capital Reserve, Securities Premium Reserve, General Reserve or from the Statement of Profit & Loss in that sequence.

- The discount on issue of debentures is allowed on allotment.

Topic – 2 | Issue of Debentures for Consideration other than Cash:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

II. ISSUE OF DEBENTURES FOR CONSIDERATION OTHER THAN CASH

A. On Purchase of Assets

- Where a company has purchased assets from a vendor and enters into an arrangement with the said vendor that instead of settlement of his dues in cash, the vendor agrees to accept fully paid debentures of the company issued to them.

- These debentures can be issued at par, at premium or discount and the number of debentures to be issued will depend upon the price at which the debentures are issued and the amount payable to the vendor

- The number of debentures issued to the vendor will be calculated as = Amount Payable/Issue Price

B. On Purchase of Business

- Where a company purchases business of another entity and enters into an arrangement with the said entity that instead of settlement of their dues in cash, the owners of the entity agrees to accept fully paid debentures of the company issued to them.

- These debentures can be issued at par, at premium or at discount and the number of debentures to be issued will be calculated as Purchase Consideration Amount/Issue price

C. Issue of Debentures to Promoters

- Sometimes debentures are issued to the promotors of the company in lieu of the services provided by them during the incorporation of the company.

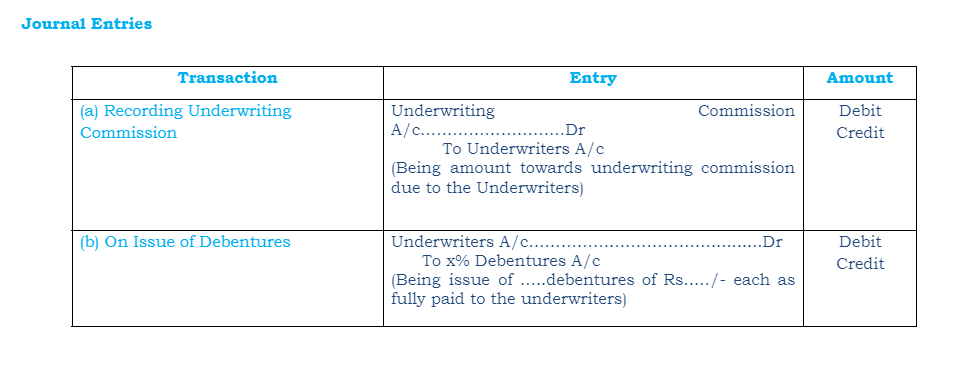

D. Issue of Shares to Underwriters

- Underwriters undertake to subscribe the securities that remain unsubscribed by public. The Underwriter charges a commission for his servicers.

Topic – 3 | Issue of Debentures as Collateral Security:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

III. ISSUE OF DEBENTURES AS COLLETERAL SECURITY

- A collateral security may be defined as a subsidiary or secondary or additional security besides the primary security

- Whenever a company takes loan from bank or any financial institution it may issue its debentures as secondary security

- Such an issue of debentures is known as ‘Issue of Debentures as Collateral Security’

- No interest is paid on the debentures issued as collateral security because company pays interest on loan

- The liability of the Company is towards the loan availed and not for the face value of debentures issued

- If the company fails to repay the loan along with interest, the lender is free to receive his money from the sale of primary security and if the realisable value of the primary security falls short to cover the entire amount, the lender has the right to invoke the benefit of collateral security whereby debentures may either be presented for redemption or sold in the open market.

- In case the need to exercise this right does not arise, debentures will be returned back to the company.

Accounting Treatment

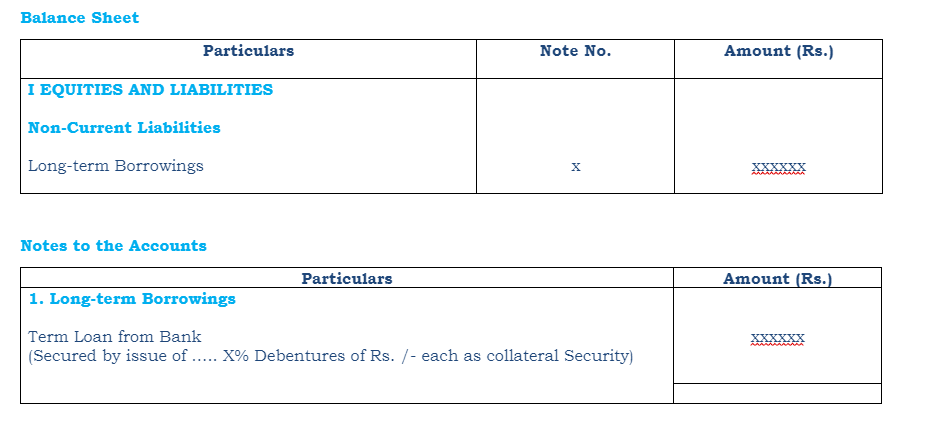

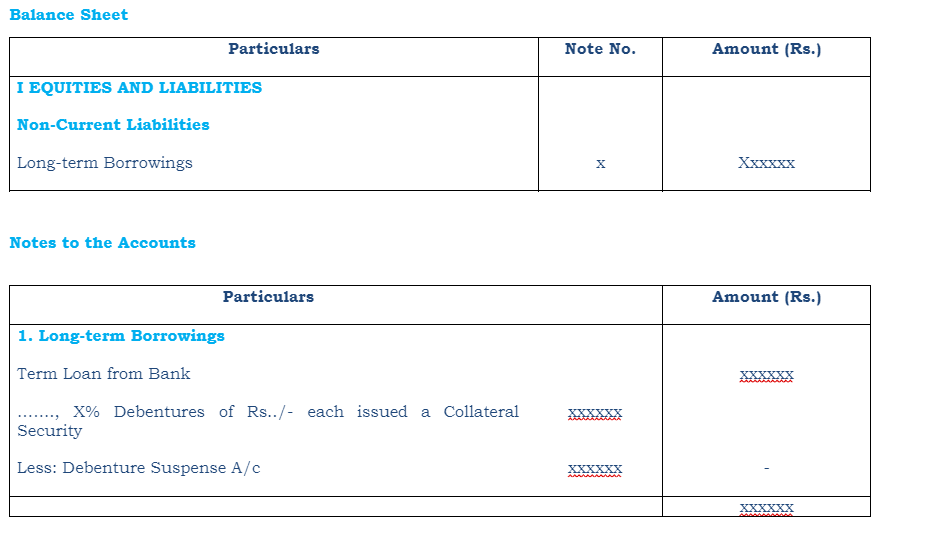

Method-1 No Journal Entry is passed

- No entry is made in the books of accounts since no liability is created by such issue.

- However, on the liability side of the balance sheet, below the item of loan, a note to the effect that it has been secured by issue of debentures as a collateral security is appended.

Disclosure in the Balance Sheet

Method-2 Journal Entry is passed

Disclosure in the Balance Sheet

Topic – 4 | Issue of Debentures from Redemption point of view:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

IV. ISSUE OF DEBENTURES FROM REDEMPTION POINT OF VIEW

- Redemption of debentures means repayment of the amount of debentures by company

- Debentures can be issued at Par, Premium or Discount

- Debentures can be redeemed at Par or Premium

- Hence there are six combination possible as depicted in the figure below

2. Debentures issued at Premium and Redeemable at Par

(Issued at Rs. 125/- and Redeemed at Rs. 100/-)

3. Debentures issued at Discount and Redeemable at Par

(Issued at Rs. 95/- and Redeemed at Rs. 100/-)

Discount on issue of debentures is netted off from Securities Premium Reserve (if it exists) or from the Statement of Profit & Loss Account in the year debentures are allotted

4. Debentures issued at Par and Redeemable at Premium

(Issued at Rs. 100/- and Redeemed at Rs. 110/-)

5. Debentures issued at Premium and Redeemable at Premium

(Issued at Rs. 125/- and Redeemed at Rs. 110/-)

6. Debentures issued at Discount and Redeemable at Premium

(Issued at Rs. 95/- and Redeemed at Rs. 110/-)

Disclosure in the Balance Sheet

Case-A Debentures are due for redemption after 12 months/operating cycle from the Balance Sheet date Balance Sheet

- Debentures will be shown under the heading ‘Long-term Borrowing’

- Premium on Redemption of Debentures will be shown under the heading ‘Other Long-term Liabilities’

Case-B Debentures are due for redemption within 12 months/operating cycle from the Balance Sheet date

- Debentures will be shown under the heading ‘Short-term Borrowing’

- Premium on Redemption of Debentures will be shown under the heading ‘Other Current Liabilities’

Topic – 5 | Interest on Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

V. INTEREST ON DEBENTURES

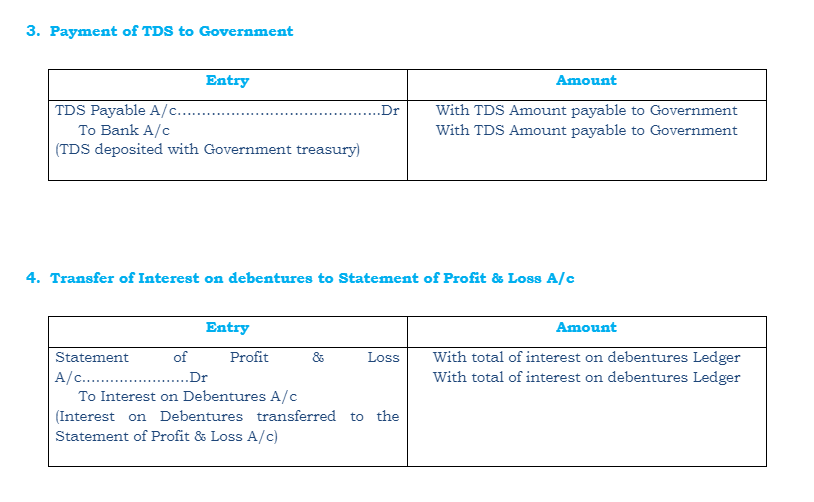

- When a company issues debentures, it has to pay interest thereon at fixed percentage periodically (quarterly/half yearly/yearly) until debentures are repaid

- Interest is computed at the nominal value of debentures.

- This percentage is usually as part of the name of debentures like 8% debentures, 10% debentures, etc.

- Interest on debenture is a charge against the profit of the company and must be paid regularly even when Company suffers a loss or does not earn profits.

- According to Income Tax Act, 1961, a company paying interest on debentures is required to deduct income tax at the prescribed rate from the gross amount of debenture interest (if it exceeds the prescribed limit) before any payment is made to the debenture holders (Tax Deducted at Source).

Illustration

Debenture Face Value | Rs. 100 |

Number of Debentures | 10,000 |

Period | 6 months |

Interest rate | 9% per annum |

Profit & Loss A/c | Loss Rs. 75,00,000 |

Interest Amount | (10,000×100)x9%x6/12 = Rs. 45,000 |

Income Tax (TDS) @ 10% | 45,000×10% = Rs. 4,500/- |

Interest Net of TDS | 45,000-4,500=Rs. 40,500 |

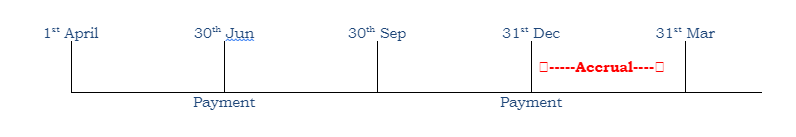

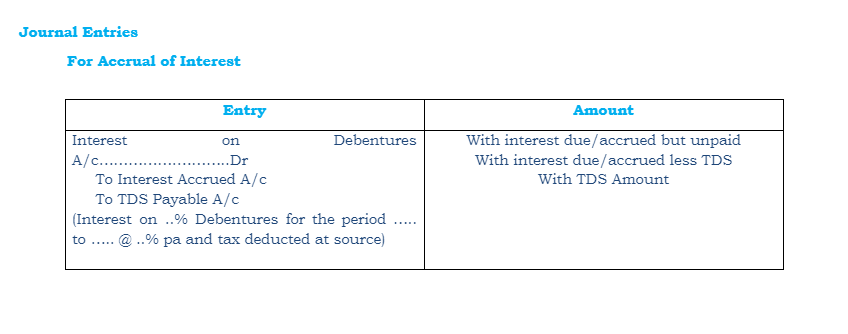

Interest on Debentures – Accrual

- Interest may be paid periodically and the period may be quarterly, half-yearly or yearly

- The date of payment of interest may be coincide with the end of the accounting period

- For example interest is payable half yearly on 30th Jun and 31st December

- In this case, at the end of the accounting year on 31st March, interest for the period 1st Jan to 31st Mar needs to be accrued in the books of accounts

Topic – 6 | Writing Off Discount/Loss on Issue of Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

VI. WRITING OFF DISCOUNT/LOSS ON ISSUE OF DEBENTURES

- Discount or Loss on issue of debentures is a capital loss and is written-off in the year it is incurred i.e. in the year debentures are allotted.

- Discount or loss is written-off from the following:

- From Capital Reserve

- From Securities Premium Reserve [section 52(2)]

- From General Reserve

- Against revenue profits of the year